Improving Cash Flow and Revenue with Text-to-Pay in Veradigm

💡 Text-to-pay helps imaging centers improve cash flow with Veradigm by speeding up payment collection. It cuts down the time patients take to pay...

Table of Contents

A patient receives care at your facility on Tuesday morning. The billing team processes the claim by Thursday. The statement goes out the following week. The patient calls three days later asking about their balance. Your team spends ten minutes explaining the charges. The patient promises to pay but needs to find their wallet. They call back. The cycle repeats.

This scenario plays out thousands of times across Oracle Health systems every month. Each interaction consumes staff time. Each delay extends your accounts receivable. Each phone call pulls your team away from complex billing issues that actually need human attention.

Large healthcare networks face a fundamental challenge. You manage high volumes of co-pays, post-visit balances, and deductibles across multiple departments and locations.

Traditional billing methods create bottlenecks. Paper statements take days to arrive. Patient portals require login credentials that patients forget. Phone calls generate voicemail cycles that stretch collection timelines.

Text-to-pay for Oracle Health systems offers a different approach. Payment links reach patients directly on their phones. Patients complete transactions without navigating portals or waiting on hold. Your billing team sends automated payment requests at the right moments in the care journey.

The result is faster payment completion and reduced operational friction. Text-to-pay doesn't just speed up collections. It creates predictable revenue cycle workflows that scale across your entire health system. Your staff stops chasing routine payments and starts addressing exceptions that require expertise.

This shift matters for enterprise operations. When payment communication becomes automated infrastructure instead of manual outreach, you gain consistency. You reduce variability in collection performance.

The following sections explain how text-to-pay transforms patient payment workflows in large healthcare environments.

Oracle Health systems operate at scale. You manage tens of thousands of patient encounters each month. Each encounter generates billing events. Some require co-pay collection before care delivery. Others trigger balance notifications after insurance processing. Many involve multiple touch points across scheduling, care delivery, and follow-up.

Traditional billing communication struggles under this volume. Your team sends statements. Patients receive them days later. Some patients call to ask questions. Others ignore the notices entirely. Your billing staff makes outbound calls. They leave voicemails. They try again later. The manual effort compounds across departments.

Text-to-pay introduces faster workflows. Payment requests reach patients within minutes of being sent. Patients see clear instructions and a direct payment link. They complete the transaction from their phone. The payment posts to their account immediately. Your team receives confirmation without making a single call.

This speed creates operational advantages. You reduce the time between service delivery and payment receipt. You shorten your days in accounts receivable. You improve cash flow predictability across the health system.

Delayed payments create cascading effects in enterprise revenue cycle operations. Extended days in accounts receivable reduce your working capital. Your finance team faces uncertainty when projecting monthly collections. Your billing department allocates more resources to follow-up outreach.

Consider a typical scenario:

A patient owes $200 after insurance processing. Your system generates a paper statement. The patient receives it five days later. They set it aside intending to pay online later.

Two weeks pass. Your billing team makes an outbound call. The patient doesn't answer. Your team leaves a voicemail. The patient calls back three days later and asks for the balance amount again. They promise to pay soon. Another week passes before payment arrives.

This timeline extends 25 days from statement generation to payment receipt. Multiply this across thousands of patient accounts and the impact grows.

Your team spends hours on billing follow-up calls. Your call center handles repetitive questions about balance amounts and payment options. Your staff experiences frustration managing routine payment coordination instead of solving complex billing issues.

Patient confusion adds to the problem. Patients navigate multiple portals with different login requirements. They receive statements with unclear payment instructions. They call your billing department asking how to pay. Each interaction consumes staff time and delays payment completion.

Text-to-pay addresses these delays directly. Payment requests arrive instantly. Patients access payment links without credentials. Clear messaging reduces confusion. Faster response shortens collection timelines. Your team monitors payment completion instead of making follow-up calls.

The shift from manual outreach to automated payment communication creates measurable efficiency gains. Enterprise health systems need payment workflows that scale. Text-to-pay provides infrastructure that supports growth without proportional increases in billing operations workload. You standardize payment communication across departments.

You reduce variability in how different teams handle collections. You create consistent patient experiences regardless of which facility or service line generated the charges.

This consistency matters for organizations managing complex revenue cycles.

When payment communication becomes predictable and automated, you gain operational control. You reduce the operational noise created by fragmented billing processes. You build a foundation for better revenue cycle performance across your entire health system.

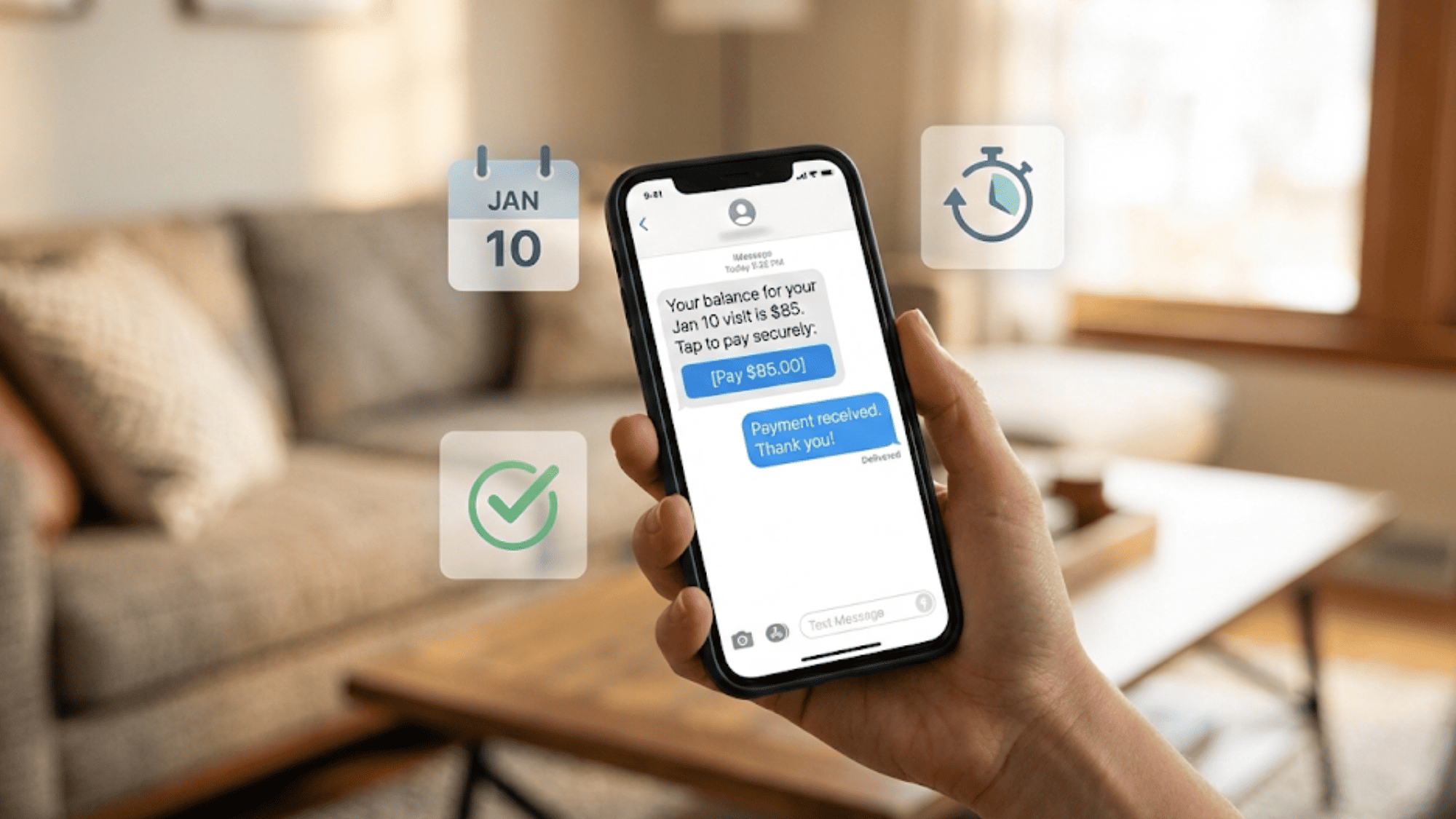

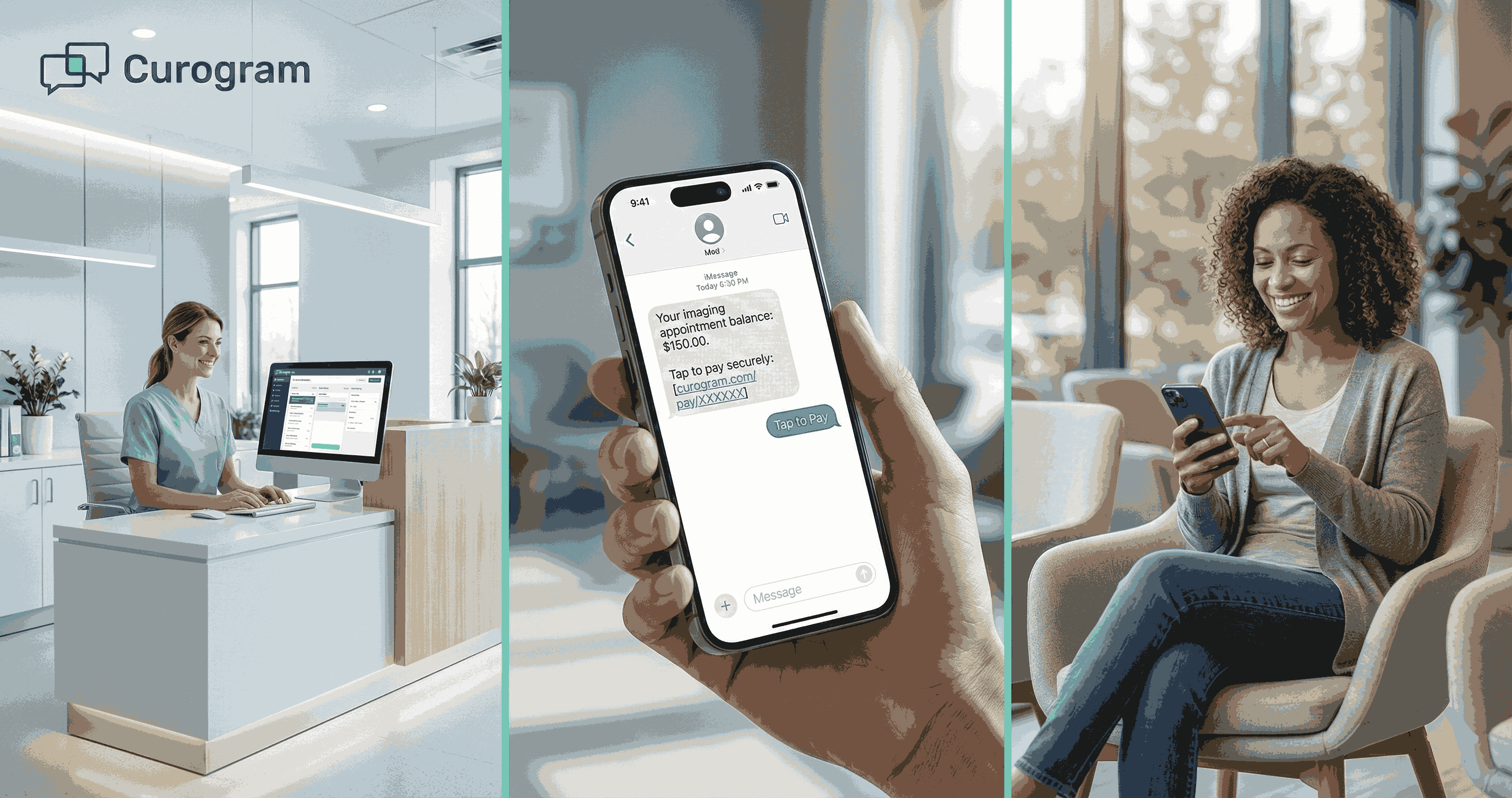

Text-based payment links change how patients interact with medical billing. Instead of receiving a paper statement days after care, patients get a text message with clear instructions and immediate payment access. The message explains the balance amount and provides a secure link to complete the transaction.

This directness eliminates common friction points. Patients don't search for portal credentials. They don't navigate complex website menus. They don't call your billing department asking where to send payment. They click the link, enter payment details, and finish the transaction in under two minutes.

The simplicity matters for patient response rates. People check text messages within minutes of receiving them. Payment links are accessible immediately. Patients can complete transactions while the care experience is still fresh in their minds. This timing improves payment completion compared to statements that arrive days later.

Timing affects payment behavior. A co-pay reminder sent the morning of an appointment gives patients time to prepare. A balance notification sent two days after care arrives while patients still remember the visit. A post-discharge payment request reaches patients when they're ready to close out medical expenses.

Text-to-pay enables precise timing. Your system triggers payment messages based on care events. Pre-visit co-pay reminders go out 24 hours before appointments. Post-visit balance notifications send once insurance processing completes. Follow-up reminders deliver if initial payment requests go unanswered.

Clear messaging reduces patient uncertainty. Each text includes the balance amount, the reason for the charge, and simple payment instructions. Patients understand what they owe and why. They see exactly how to pay. The transparency builds confidence and encourages faster response.

Compare this to traditional billing communication. Paper statements include multiple charges with unclear descriptions. Patients receive them days after care. They set them aside meaning to review later. Questions arise. They call your billing department. Your staff explains the charges. The patient asks how to pay. Your team provides payment options. The conversation extends five to ten minutes. The patient still hasn't paid.

Text-to-pay compresses this timeline. The message arrives with full context. The payment link works immediately. The patient completes the transaction without staff intervention. Your team saves time. The patient avoids confusion. Payment posts faster.

Billing phone calls consume significant staff resources in large health systems. Patients call asking about balance amounts. They call requesting payment options. They call because they lost the statement. They call to confirm receipt of their payment. Each call requires staff time and diverts attention from complex billing issues.

Text-to-pay reduces these call volumes. Payment messages include all necessary information upfront. Patients see their balance amount in the text. They access payment options via the link. They receive confirmation once payment completes. The self-service workflow answers questions before patients think to call.

Your call center experiences tangible relief. Fewer inbound calls about routine payments mean shorter wait times for patients with genuine billing questions. Your staff addresses payment plan requests, insurance disputes, and financial assistance applications instead of explaining how to pay a $50 balance.

Outbound call volume drops as well. Your billing team stops making routine payment follow-up calls. Automated reminders handle payment outreach. Your staff makes calls only when payments remain outstanding after multiple automated attempts. This targeted approach uses staff time more efficiently.

The operational impact extends beyond call reduction. Your team experiences less repetitive work. Staff morale improves when people focus on meaningful problem-solving instead of routine payment coordination. Your billing department operates more efficiently without adding headcount.

Revenue cycle predictability determines how well your finance team can forecast cash flow and allocate resources. Unpredictable payment patterns create planning challenges. When payments trickle in over weeks instead of arriving in consistent windows, your working capital fluctuates. Your finance department struggles to project monthly collections accurately.

Text-to-pay creates more predictable revenue patterns. Automated payment requests go out at consistent intervals after care delivery. Patients respond faster because payment access is immediate. Your team tracks payment completion rates and identifies patterns.

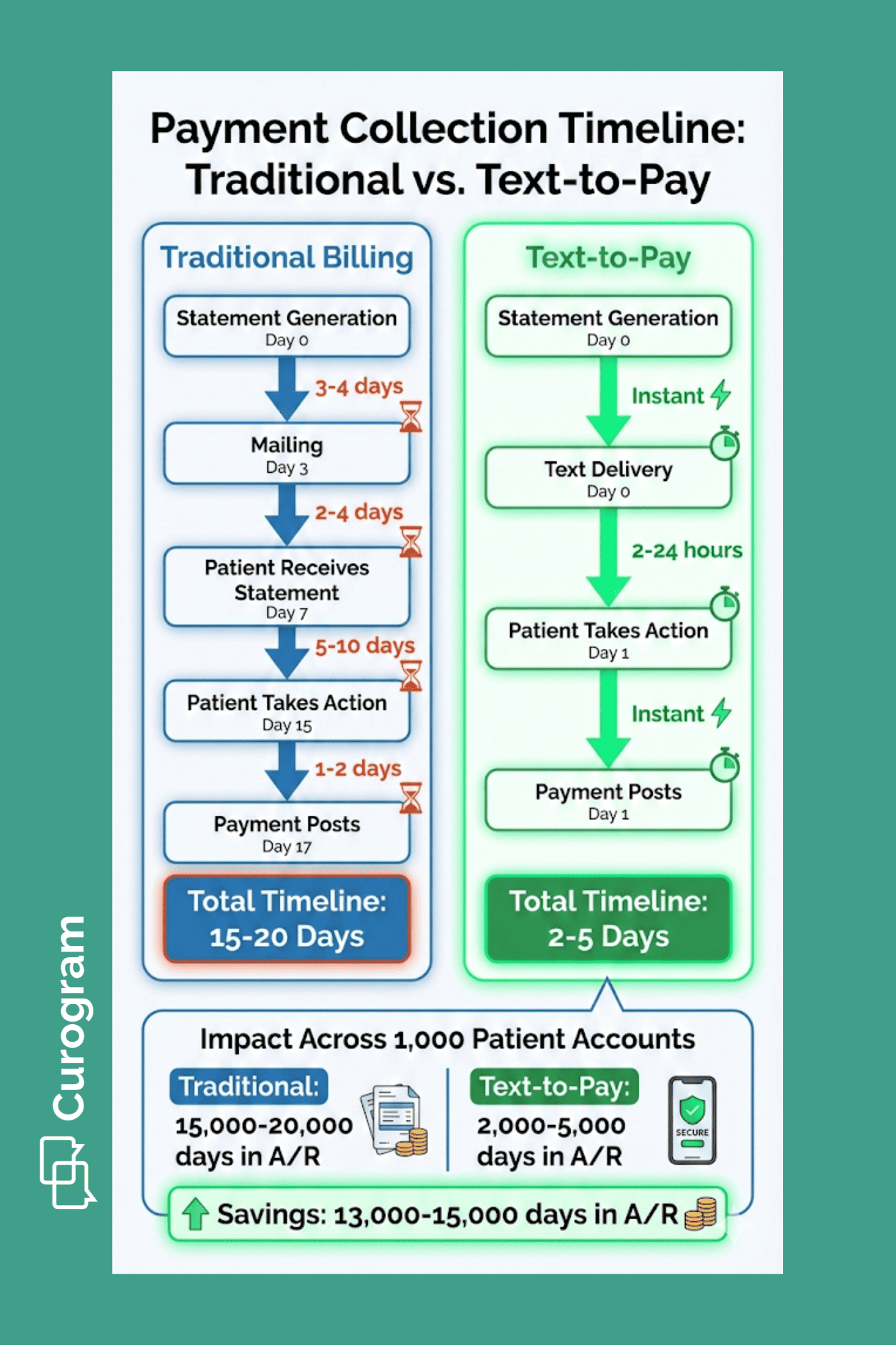

Consider the traditional revenue cycle timeline:

A patient receives care on Monday. Insurance processing takes five business days. Your billing system generates a statement on the following Monday. The statement reaches the patient by Thursday. The patient reviews it over the weekend and pays online the next Tuesday. Total timeline: 15 days from service delivery to payment receipt.

Now, consider the text-to-pay timeline:

The patient receives care on Monday. Insurance processing completes by Friday. An automated text goes out Friday afternoon with the balance and payment link. The patient pays Saturday morning. Total timeline: 5 days from service delivery to payment receipt.

This compression creates predictable cash flow. You know when payment requests go out.

You track response rates. You identify which payment amounts see faster completion. You adjust reminder timing based on response data. The systematic approach turns payment collection into a managed process instead of a passive waiting game.

Mobile-friendly payment access drives faster response. Patients carry their phones constantly. When a payment text arrives, they can address it immediately. They don't need to sit down at a computer. They don't need to remember to pay later. The payment link works on any device and requires no special apps or software.

This convenience shows in payment timing data. Many patients complete text-to-pay transactions within hours of receiving the payment link. Some pay within minutes. The immediate response reduces the lag time that extends collection timelines in traditional billing workflows.

Mailed statements create inherent delays. The statement sits in your outgoing mail for a day. Postal delivery takes two to four days. The patient receives it and sets it aside. Days or weeks pass before the patient takes action. Even motivated patients who intend to pay promptly face delays built into the paper-based process.

Text-to-pay eliminates these delays. The message arrives instantly. The payment link is active immediately. Patients complete transactions when it's convenient for them. Many choose to pay right away rather than adding the task to their mental to-do list.

Reduced delays affect your entire revenue cycle. Faster payment completion means cash arrives sooner. Your days in accounts receivable decrease. Your finance team has better visibility into expected cash receipts. Your budget planning becomes more accurate because revenue timing is more consistent.

Large health systems face consistency challenges. Different departments may handle billing communication differently.

One clinic sends payment reminders weekly. Another waits two weeks. One service line calls patients who don't pay within ten days. Another gives patients 30 days before outbound outreach. This variability creates uneven collection performance and confuses patients who receive care across multiple locations.

Text-to-pay establishes standard payment workflows. Your revenue cycle team defines when payment requests send. All departments follow the same timeline. Co-pay reminders go out 24 hours before appointments system-wide. Post-visit balance notifications send three days after care. Follow-up reminders deliver at consistent intervals.

This standardization improves collection performance across the health system. Departments that previously struggled with collections see improvement because they now use the same effective workflows as higher-performing areas.

Patients receive consistent communication regardless of which facility they visit. Your revenue cycle team monitors performance centrally and identifies opportunities for optimization.

Centralized governance becomes possible when payment communication is automated. Your revenue cycle leadership sets policies for payment request timing, message content, and reminder frequency. These policies apply across the entire health system.

Better forecasting follows from consistency. When payment workflows are standardized, you can predict collection patterns more accurately. You know what percentage of patients pay within 24 hours of the first payment request. You know how many require one reminder versus multiple reminders.

Reporting improves as well. You track payment completion rates by department, service line, and payment amount. You identify which workflows generate the best results. You spot problems early when a particular clinic's payment completion rate drops. You make data-driven decisions about payment communication strategy.

The operational benefits compound over time. Consistent workflows reduce the cognitive load on your billing staff. Enterprise billing consistency also supports compliance efforts. Standardized workflows mean standardized documentation.

Text-to-pay transforms payment communication from a fragmented, department-level activity into centrally managed infrastructure. Your revenue cycle becomes more predictable. The foundation you build supports continued growth without proportional increases in billing operations complexity.

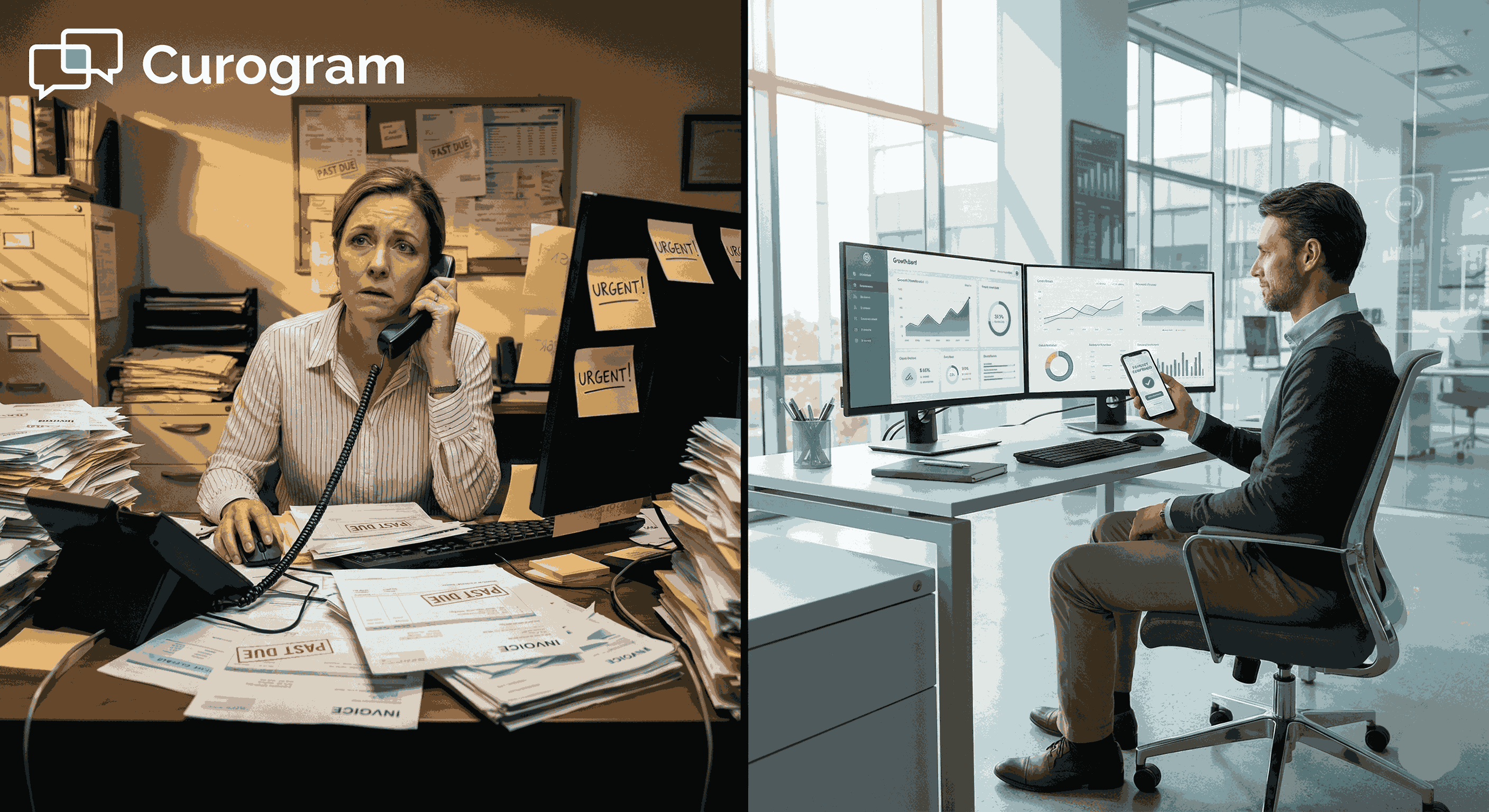

Billing departments in large health systems handle enormous transaction volumes. Every patient encounter generates potential billing activity. Your team processes claims, posts payments, sends statements, answers patient questions, and manages collections. Much of this work is repetitive and manual.

Text-to-pay automates the repetitive elements. Payment requests send automatically based on triggers you define. Reminders deliver on schedule without staff intervention. Payment confirmations post to patient accounts instantly. Your team monitors the process instead of executing each step manually.

Manual payment follow-up consumes significant staff time. A billing specialist reviews accounts with outstanding balances. They pull phone numbers. They make calls. Many calls go to voicemail. They leave messages. They document each attempt. They schedule follow-up calls for later. The cycle repeats until payment arrives or the account goes to collections.

This process doesn't scale well. One staff member might make 50 calls per day. Many patients don't answer. Those who do often promise to pay later. Actual payment completion from a single round of calls might be 10% to 15%. Your team makes hundreds of calls to collect dozens of payments.

Text-to-pay handles follow-up automatically. The system sends a payment request. If the patient doesn't pay within a defined window, an automated reminder goes out. If the patient still doesn't respond, another reminder delivers. Your staff intervenes only when automated reminders fail to generate payment.

The efficiency gain is substantial. One staff member who previously made 50 calls per day can now monitor thousands of automated payment workflows. They focus on accounts that need human intervention. They handle payment plan requests. They work with patients experiencing financial hardship. They address billing disputes that require investigation.

Every billing department faces complex cases. Insurance denials that require appeals. Payment plans that need custom terms. Financial assistance applications that need review. Billing disputes that need investigation. These cases require expertise, judgment, and time.

When your staff spends hours on routine payment follow-up, complex cases get less attention. Denials sit longer before appeals. Payment plan requests take days to process. Financial assistance applications create backlogs. Your team feels pulled between high-value work and repetitive tasks.

Text-to-pay shifts this balance. Routine payment collection runs automatically. Your staff reallocates time to complex cases. Denials get faster appeals. Payment plans get quicker approvals. Financial assistance applications move through review more smoothly. Your team's expertise focuses where it creates the most value.

Staff morale improves when work becomes more meaningful. Nobody enters healthcare billing to make routine payment reminder calls. People want to solve problems and help patients. When automation handles repetitive tasks, your team does more of the work they find rewarding.

Billing interactions shape patient perception of your health system. A confusing billing process creates frustration. Unclear payment options generate anxiety. Difficult payment experiences damage trust. These negative impressions affect patient loyalty and willingness to return for future care.

Text-to-pay improves the patient financial experience. Payment requests are clear and timely. Payment access is simple and immediate. The process respects patient time and reduces unnecessary complexity.

Patients appreciate straightforward payment options. Text-to-pay delivers simplicity. The payment link works on any device. No app download is required. No portal login is needed. Patients enter payment details and complete the transaction in under two minutes.

This ease matters for patient satisfaction. People lead busy lives. They don't want to spend 15 minutes navigating a patient portal to pay a medical bill. They want quick, simple payment access. Text-to-pay provides exactly that.

Medical bills create stress for many patients. They worry about unexpected costs. They feel uncertain about what they owe. They struggle to understand complex billing statements. This anxiety affects their overall perception of care.

Text-to-pay reduces some of this anxiety through clarity and timing. Payment requests arrive with clear context. Patients see the exact amount owed. They understand the charge relates to their recent care. The transparent communication builds confidence.

Timely notifications also help. When payment requests arrive shortly after care, patients connect the bill to the service they received. The context is fresh. They remember the visit and understand why they owe money. This timing reduces confusion compared to statements that arrive weeks later when memory has faded.

Transparent requests eliminate common sources of patient confusion. Each text message includes the balance amount and the reason for the charge. Patients don't wonder what they're paying for. They don't need to call your billing department asking for clarification. The information they need appears in the initial payment request.

Payment workflows don't exist in isolation. They connect to scheduling, patient intake, care delivery, and follow-up processes. Text-to-pay needs to integrate with these workflows to be effective. Disconnected tools create friction and reduce adoption.

Oracle Health systems require payment communication that works within existing workflows. Your scheduling team needs to trigger co-pay reminders when appointments are confirmed. Text-to-pay must support these scenarios seamlessly.

Pre-visit co-pay collection improves cash flow and reduces no-shows. Patients receive a text reminder 24 hours before their appointment. The message includes the appointment details and the expected co-pay amount. It provides a payment link. Patients pay before arriving. Your front desk staff doesn't handle payment transactions during check-in.

Post-visit balance notifications handle charges that emerge after insurance processing. A patient completes care on Monday. Insurance processes the claim by Friday. Your system calculates the patient responsibility. An automated text goes out Friday afternoon with the balance and payment link.

Telehealth visits create unique payment needs. Patients complete virtual visits from home. They don't stop at a front desk to pay. Text-to-pay provides a natural payment channel. The patient finishes the telehealth session. A payment request arrives via text. They complete payment from the same device they used for the visit.

Scalability requires triggered workflows. Your system identifies payment events automatically. An appointment gets scheduled. A claim processes. A balance posts to a patient account. These events trigger payment communication without manual intervention.

Predictable delivery matters for patient experience. Patients learn to expect payment requests at consistent times. They recognize the format. They understand the process. This familiarity reduces confusion and improves response rates.

Central governance ensures consistency. Your revenue cycle team defines payment workflows once. Those workflows apply across the entire health system. Updates and improvements deploy centrally. You avoid the fragmentation that comes from department-level tools and practices.

Payment messages may reference protected health information. A text might mention the date of service, the type of care received, or the balance amount. These details could identify a patient and their health status. Oracle Health systems must handle this information securely and in compliance with HIPAA requirements.

Text-to-pay platforms built for healthcare understand these requirements. Messages deliver through secure channels. Access controls prevent unauthorized viewing. Audit logs track all communication. Your compliance team can verify that payment communication meets regulatory standards.

HIPAA compliance requires appropriate safeguards for PHI. Text-to-pay platforms use encryption for message transmission. Patient data stays protected in transit and at rest. Access requires authentication. Only authorized users can view payment communication records.

Message content follows best practices. Texts avoid unnecessary clinical details. They include minimum necessary information to support payment. Balance amounts and service dates appear only when needed. The approach balances patient convenience with privacy protection.

Controlled access prevents data exposure. Your billing staff sees payment communication related to their assigned accounts. They can't access records for patients they don't serve. Role-based permissions ensure appropriate access levels. Your compliance team monitors access patterns and identifies anomalies.

Enterprise health systems face regular audits. Regulators review billing practices. Internal compliance teams verify adherence to policies. External auditors examine revenue cycle controls. These reviews require documentation of payment communication activities.

Text-to-pay platforms provide centralized records. Every payment request is logged. Every reminder is documented. Every patient response is tracked. Your compliance team can pull reports showing all payment communication for specific time periods, departments, or patient populations.

Clear accountability supports compliance. The system shows who configured payment workflows. It tracks when messages sent. It records patient payment responses. This transparency helps your organization demonstrate compliance with regulatory requirements and internal policies.

Compliance-ready documentation reduces audit burden. Your team doesn't manually compile payment communication records. The system generates reports automatically. Auditors get the information they need quickly. Your staff spends less time on audit preparation and more time on operational improvement.

Enterprise healthcare environments have specific needs. You require reliable infrastructure that handles high message volumes. You need compliance features that meet regulatory standards. You want governance tools that support centralized management across multiple departments and locations.

Curogram provides text-to-pay built for these requirements. The platform supports large health systems with complex revenue cycle operations. It delivers enterprise-grade reliability and security. It enables centralized governance while allowing appropriate local flexibility.

Reliable delivery matters when you're sending thousands of payment messages daily. Curogram's infrastructure handles enterprise message volumes without degradation. Messages deliver promptly and consistently. Your patients receive payment requests when expected.

Predictable workflows support operational planning. You define payment communication rules once. The system executes those rules automatically. Your team monitors performance and adjusts as needed. The consistent operation reduces surprises and improves revenue cycle predictability.

Enterprise-ready compliance protects your organization. Curogram meets HIPAA requirements for healthcare communication. The platform includes encryption, access controls, and audit capabilities. Your compliance team has the tools needed to verify regulatory adherence and demonstrate appropriate safeguards.

Text-to-pay transforms patient payment workflows in large healthcare environments. Faster payment completion shortens collection timelines and improves cash flow.

Reduced billing calls free up staff for complex issues. Automated payment communication creates predictable revenue cycle operations.

Oracle Health systems use text-to-pay as revenue cycle infrastructure. The approach standardizes payment communication across departments.

It reduces operational variability. It improves the patient financial experience. It enables better forecasting and resource planning.

Explore specific implementation approaches and operational outcomes that large health systems achieve with text-based patient payment communication.

How Curogram Supports Oracle Health Payment Workflows

Curogram delivers text-to-pay designed for Oracle Health systems and other enterprise healthcare environments. The platform handles the complexity of large-scale patient communication while maintaining the simplicity that drives patient response.

Built-in compliance features protect your organization. HIPAA-compliant message delivery ensures patient data stays secure. Encryption protects information in transit and at rest.

Access controls limit who can view payment communication records. Audit logs provide documentation for compliance reviews. Your team implements text-to-pay without creating new compliance risks.

Integration with Oracle Health workflows happens through standard healthcare APIs. Payment triggers connect to your EHR scheduling, billing, and registration systems. Co-pay reminders send when appointments are confirmed. Balance notifications deliver after insurance processing.

The automated workflows operate within your existing care delivery infrastructure. Centralized governance supports enterprise operations. Your revenue cycle leadership defines payment communication policies.

Analytics provide visibility into payment performance. You track completion rates by department, service line, and payment amount. You identify which workflows generate strong results. Data-driven insights support continuous improvement in your revenue cycle operations.

The platform scales with your organization. Whether you're sending hundreds or tens of thousands of payment messages monthly, Curogram's infrastructure handles the volume reliably. You add new departments or locations without rearchitecting your payment communication system.

Curogram's support team understands enterprise healthcare. Implementation includes workflow design assistance. Your team gets guidance on optimal payment timing and message content. Ongoing support helps you adapt as your needs evolve. You have a partner invested in your revenue cycle success.

Text-to-pay with Curogram becomes infrastructure you depend on. Reliable, compliant, scalable, and built specifically for health systems managing complex patient payment operations at enterprise scale.

Text-to-pay for Oracle Health systems addresses core revenue cycle challenges that large healthcare organizations face. Traditional billing methods create delays, consume staff time, and frustrate patients.

Paper statements take days to arrive. Patient portals require credentials. Phone calls generate voicemail cycles. These friction points extend collection timelines and reduce payment predictability.

Text-based payment communication eliminates these bottlenecks. Payment links reach patients instantly. Patients complete transactions without portal logins or phone calls. Your billing team sends automated requests and monitors results instead of making manual follow-up calls. The process scales across your entire health system without proportional increases in staffing.

The operational benefits extend beyond faster collections. Your call center handles fewer routine payment questions. Your billing staff focuses on complex cases that require expertise. Your finance team gains better cash flow visibility. Your patients experience simpler, less stressful payment interactions.

Implementation requires choosing infrastructure built for enterprise healthcare. You need reliable message delivery at scale. You need compliance features that meet HIPAA standards. You need governance tools that support centralized management. You need integration with Oracle Health workflows.

Text-to-pay becomes revenue cycle infrastructure when implemented properly. It standardizes payment communication across departments. It creates predictable workflows that improve forecasting. It reduces operational variability that causes collection performance gaps. It builds a foundation for continued growth.

Support your broader goals of financial health and patient satisfaction. Book a demo today to see how Curogram supports better care workflows with Oracle Health.

Automated workflows eliminate manual payment follow-up calls and reminder mailings. The system sends payment requests and reminders based on predefined triggers. Staff monitor results and intervene only for accounts needing special attention. This automation allows teams to manage higher payment volumes without adding headcount.

Text reminders can trigger automatically when appointments are confirmed. Patients receive co-pay notifications 24 hours before visits with immediate payment access. They complete payment before arriving. This automation works across hundreds of daily appointments without front desk staff managing individual payment transactions during check-in.

Platforms built for healthcare use encrypted message delivery and secure payment links. Messages include minimum necessary information. Access controls limit who can view payment records. Audit logs document all communication. These safeguards protect patient data while enabling convenient text-based payment access.

💡 Text-to-pay helps imaging centers improve cash flow with Veradigm by speeding up payment collection. It cuts down the time patients take to pay...

💡 Text-to-pay in Veradigm helps imaging centers collect payments faster and reduce admin work. This mobile payment method sends secure links...

💡 Patient payment workflows help Meditab IMS teams collect payments faster and reduce staff workload. These workflows automate billing tasks that...