How Athenahealth Clinics Can Use Text-to-Pay to Improve Collections

💡 For Athenahealth users, text-to-pay collections offer a faster and more secure billing process. Mobile payments are also a patient-friendly way...

16 min read

.jpg) Mira Gwehn Revilla

:

Updated on January 23, 2026

Mira Gwehn Revilla

:

Updated on January 23, 2026

Table of Contents

A billing coordinator at a large Oracle Health system sends 40 payment reminder calls each day. Half go to voicemail. Most callbacks never happen.

Meanwhile, three floors up, another team sends different payment messages for the same services. Patients get confused. Collections slow down. Staff waste hours on repetitive tasks.

This scenario plays out daily across health systems. Manual billing outreach doesn't scale well. When each department handles payment collection differently, patients receive mixed messages. Some get calls. Others get voicemails. A few get emails. The result is longer payment cycles and frustrated staff.

Enterprise payment-collection workflows for Oracle Health teams solve this problem. These workflows create standard processes for billing communication.

Every department follows the same rules. Payment requests go out at the right time. Messages use clear, consistent language. The system handles routine tasks automatically.

Automated workflows reduce billing call volume by up to 60%. Staff spend less time leaving voicemails. Patients get payment links they can use right away.

Healthcare communication workflows matter more as health systems grow. While a three-location network might manage manual outreach, a 20-location system cannot.

Workflow automation maintains quality at scale. It ensures every patient gets the same clear payment experience.

Oracle Health teams that adopt payment workflows see faster collections. They also see happier staff and fewer patient complaints. The key is designing workflows that trigger at the right moments, use approved messaging, and work across all service lines.

This guide explores how enterprise payment-collection workflows transform billing operations. You'll learn how to trigger payment requests, reduce call volume, coordinate multi-department billing, and maintain HIPAA compliance.

Oracle Health systems process thousands of patient payments each month. A mid-size network might handle 15,000 billing transactions across 12 locations. Without automation, each transaction needs one-by-one follow-up.

Manual billing outreach does not scale reliably. When billing staff make individual calls or send one-off messages, consistency breaks down.

One location might call patients twice. Another might wait two weeks. Patients notice these differences. They start to question whether the system is organized.

Consider a patient who visits two departments in the same health system. The first department texts a payment link within 24 hours. The second department calls three days later and leaves a voicemail. The patient wonders why the process differs. This confusion leads to delayed payments and extra calls to billing support.

Inconsistent payment workflows increase delays and patient confusion. When there's no standard process, some patients fall through the cracks.

Others get too many contacts. Billing staff spend time deciding when to reach out instead of following a proven system. This variability costs time and money.

Workflow-based collections improve predictability and control. A well-designed workflow triggers payment requests at set times. Pre-visit co-pays go out 48 hours before appointments.

Meanwhile, post-visit balances get sent within 24 hours of service. Follow-up reminders happen on day seven if the balance remains unpaid. Every patient gets the same experience.

Different departments use different payment follow-up methods. Surgery might rely on phone calls. Primary care might use patient portal messages.

The billing department might send paper statements. Patients who use multiple services get confused by the mixed approach.

Billing calls and voicemails go unanswered at high rates. Research shows that 65-70% of billing calls go to voicemail. Of those voicemails, only 20-30% result in callbacks. Staff waste hours trying to reach patients who might never check their messages.

Staff spend time on repetitive payment tasks. A billing coordinator might spend three hours daily making the same basic payment request calls. That's 15 hours per week on tasks that automation could handle. Meanwhile, complex billing issues that need human attention get less focus.

Patients receive inconsistent messages. One staff member might say "your balance is due before your next visit." Another might say "payment is optional but appreciated." These mixed messages create confusion about payment expectations. Patients don't know what rules apply to them.

Manual outreach also creates gaps in coverage. When a staff member is out sick or on vacation, payment follow-up stops. No one else knows which patients need calls that day. Collections slow down during busy periods when staff can't keep up with call lists.

Fragmented billing outreach affects revenue cycle metrics. Days in accounts receivable increase when follow-up is inconsistent. Collection rates drop when patients don't receive timely payment requests. Health systems lose revenue not because patients won't pay, but because the process for requesting payment is broken.

Enterprise payment-collection workflows fix these problems by removing variability. Every payment request follows the same trigger rules. Every message uses approved language.

The result is faster collections, lower call volume, and better patient satisfaction. Workflows turn payment collection from a manual, fragmented process into a reliable system that works at scale.

Enterprise workflows require consistent triggers and timing. They apply across the entire health system. They ensure every patient gets the same experience regardless of which department they visit.

Payment communication must be centrally governed. This means a revenue cycle team or billing leadership creates the workflow rules.

Individual departments don't make their own decisions about when to send payment requests. Central governance prevents the fragmentation that causes patient confusion.

Automation replaces ad hoc billing outreach. Instead of staff deciding each day who to call, the system sends payment requests automatically based on defined triggers. This removes human error and ensures no patient gets missed.

Pre-visit co-pay messages work best when sent 24-48 hours before appointments. This gives patients time to review the amount and make payment. It also reduces no-shows because patients who pay in advance are more likely to attend their appointments.

Here is an example:

A patient schedules a specialist visit on Monday for the following Thursday. On Tuesday evening, they receive a text message: "Your appointment with Dr. Smith is Thursday at 2 PM. Your estimated co-pay is $35. Pay now: [link]." The patient pays Wednesday morning. The front desk doesn't need to collect payment at check-in.

Post-visit balance notifications should go out within 24 hours of service. Patients remember their visit and understand the charges better when communication happens quickly. Waiting a week reduces the connection between the service and the bill.

Here is another example:

A patient leaves a clinic at 3 PM on Tuesday. By Wednesday morning, they receive a text: "Thank you for your visit yesterday. Your remaining balance is $125. View details and pay: [link]." The patient pays that afternoon because the visit is fresh in their mind.

Predictable timing improves response. When patients know they'll receive a payment request after every visit, they start to expect it.

This creates a payment culture where settling balances becomes routine. Patients stop waiting for paper statements because they know a text is coming.

Standard language and tone prevent confusion. The revenue cycle team creates approved message templates. Every department uses these templates. This ensures a patient visiting cardiology and orthopedics sees the same style of payment request.

Clear payment context helps patients understand what they owe. Messages should state the service date, provider name, and amount due. Generic messages like "you have a balance" don't provide enough information. Specific messages like "your balance from your January 10 visit with Dr. Lee is $80" give clear context.

Reduced patient confusion leads to faster payments. When messages are clear and consistent, patients don't need to call billing support to ask questions. They can review the message, click the link, and pay immediately. This reduces both payment time and call volume.

Standardized workflows also make training easier. New billing staff don't need to learn different processes for different departments. This reduces training time and improves consistency across the team.

Text-to-pay workflows succeed when they balance automation with clarity. The system handles timing and delivery automatically. The messages provide clear, specific information. Together, these elements create a payment process that works reliably at enterprise scale.

Billing-related calls are a major call center driver. In many Oracle Health systems, 30-40% of inbound calls to revenue cycle teams involve basic billing questions. "How much do I owe?" "Can I pay over the phone?" "Did you receive my payment?"

Automated payment messages reduce phone dependency. When patients receive clear payment information via text, they don't need to call for basic details. The message provides the amount, the service date, and a payment link. Most questions get answered before they're asked.

Fewer outbound billing calls free up staff capacity. A billing team that makes 200 manual payment calls per day spends roughly 50 hours per week on this task.

Automated workflows can handle 80-90% of these calls. That recovers 40 hours of staff time weekly for higher-value work.

Reduced voicemail backlogs improve staff morale. Billing staff often describe voicemail follow-up as frustrating. They leave messages that rarely get returned. They call the same patients multiple times. Automation eliminates this cycle. Patients receive text messages they can act on immediately.

Improved staff productivity extends beyond time savings. When staff aren't making repetitive calls, they can focus on cases that need personal attention.

Say, a patient with a $15,000 balance who needs a payment plan benefits from direct staff engagement. A patient with a $40 co-pay doesn't need that level of service.

The key is matching the right communication method to the right situation. Standard balances under $500 work well with automated text-to-pay messages.

Complex situations over $500 or involving insurance disputes benefit from phone calls. Workflows let teams allocate resources based on case complexity.

Clear payment links answer common questions. When a text message includes the balance amount, service date, and provider name, patients have the information they need. They don't call to ask "how much do I owe?" because the answer is in their text message.

Fewer patient callbacks reduce call center volume. A health system that receives 500 billing calls per day might deflect 150-200 of those calls through proactive text-to-pay messages. This reduction improves answer times for patients who do call with complex questions.

Smoother billing operations result from reduced call volume. When call queues are shorter, staff spend less time stressed and rushed. They can have better conversations with patients who call about complex billing issues. Patient satisfaction improves because wait times decrease.

Automation works best when messages include self-service options. A good payment text provides:

This combination answers most questions and provides an escape route for complex situations. Patients who can pay immediately do so. Patients who need help know where to call.

Consider the cumulative effect across a large system:

A 15-location Oracle Health network with 50,000 patient encounters monthly might generate 15,000 billing interactions. If manual outreach requires 3 minutes per interaction, that's 750 staff hours monthly. Automated workflows that handle 70% of these interactions save 525 hours monthly. That's equivalent to 3-4 full-time positions.

The savings compound when you factor in voicemail and callback cycles. A manual call that goes to voicemail requires a second attempt. That doubles the time investment.

Automated texts deliver once and stay in the patient's message history. They can review and act on them whenever convenient.

Some health systems worry that automation feels impersonal. The data suggests otherwise. Patients appreciate clear, timely billing information. A text message that arrives 24 hours after a visit feels responsive. A phone call that comes days or weeks later feels like a collection effort.

The key is tone. Automated messages should be professional but friendly. "Thank you for choosing our clinic. Your balance from yesterday's visit is $60. Pay securely: [link]." This approach feels helpful rather than demanding.

Automation also creates consistency that builds trust. When patients receive payment messages at the same point in every care journey, they start to see it as part of the process. It becomes expected rather than surprising. This normalization makes payment feel routine instead of stressful.

The most successful implementations combine automation with human oversight. Workflows handle routine cases automatically.

Staff monitor exceptions and intervene when needed. This hybrid approach delivers efficiency without sacrificing service quality.

Oracle Health billing workflows span many service lines. A typical health system includes primary care, specialty clinics, surgery, imaging, lab services, and emergency care. Each service line generates billing events. Without central coordination, each develops its own payment collection approach.

Workflow automation maintains consistency across all service lines. The same payment triggers apply whether a patient visits cardiology or dermatology. The same message templates work for routine visits and complex procedures.

Unified payment communication rules prevent departmental variation. The revenue cycle team sets parameters for when payment requests go out and what they say. Individual departments can't deviate from these standards.

Example:

A patient visits three departments in one month—primary care, lab, and physical therapy. With unified workflows, they receive the same style of payment message after each visit. The timing is consistent. The format is familiar. The patient knows what to expect.

Reduced departmental variation improves staff training and compliance. When every department follows the same workflow, new staff learn one system. They don't need separate training for each service line. This reduces onboarding time and prevents errors.

Better reporting follows from standardized workflows. When all departments use the same system, leadership can compare performance across service lines. Which departments have the fastest collection times? Which see the highest payment rates? These insights drive improvement.

Shared visibility into payment status helps revenue cycle teams manage workload. Instead of calling multiple departments to check on a patient's payment status, staff view one dashboard. They see all outstanding balances, all sent messages, and all payment activity in one place.

Improved workload distribution becomes possible with centralized data. When leadership sees that one service line has higher unpaid balances than others, they can allocate staff resources accordingly. This targeted approach improves overall collection performance.

Predictable collections help with financial forecasting. When workflows consistently trigger payment requests at set intervals, finance teams can predict cash flow more accurately. They know that 60% of patients pay within 48 hours of receiving a text-to-pay message. This data supports better planning.

Billing interactions affect patient trust. A confusing or aggressive billing process damages the relationship between patients and their health system. Clear, respectful payment communication builds trust even when collecting money.

Clear workflows reduce frustration. Patients appreciate knowing when to expect billing communication and what form it will take. Surprises create stress. Predictable processes create confidence.

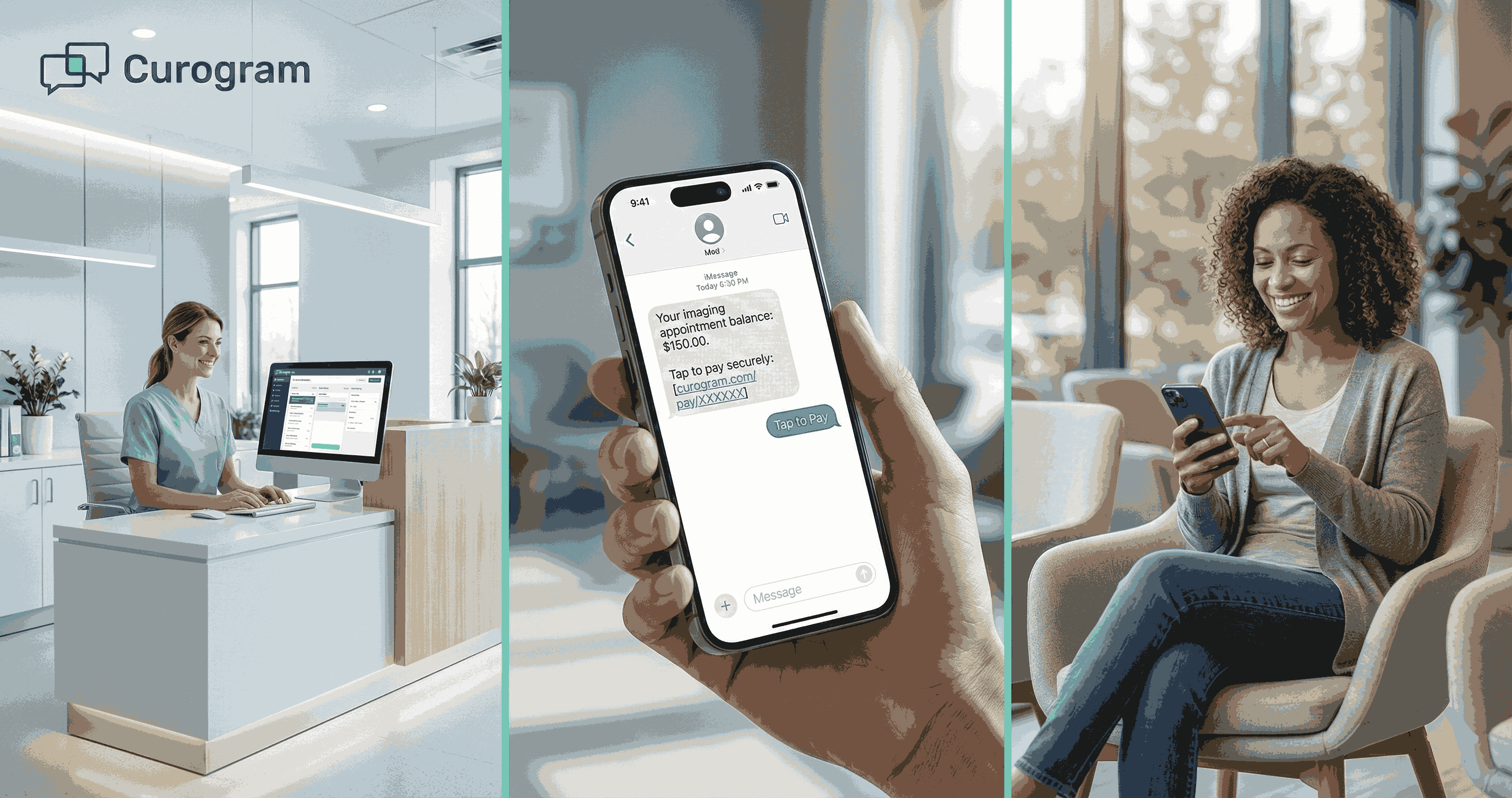

Mobile-friendly payment links work on any device. Patients can click a link from their text message and pay using their phone. No app download required. No portal login needed. The process takes less than two minutes.

No portal login required removes a major barrier. Many patients don't remember their portal credentials. Requiring a login to make a payment creates friction. Direct payment links bypass this obstacle entirely.

Clear instructions reduce errors and confusion. A good payment message tells patients exactly what to do: "Click this link to pay your $50 balance from your January 8 visit." Simple language, clear action, specific details.

Timely, transparent communication prevents payment surprises. When patients receive balance information within 24 hours of their visit, they can address it immediately. Waiting weeks for a paper statement creates anxiety and makes payment feel like an unexpected burden.

Fewer unexpected calls improve the patient relationship. Many patients associate billing calls with collection efforts. Proactive text messages feel informative rather than demanding. This shift in tone makes payment feel routine instead of stressful.

Multi-location systems require uniform billing experiences. When a health system operates 15 clinics across a region, patients may visit multiple locations. They expect the same level of service everywhere. Payment collection should work the same way at every site.

Workflow-based payment collection reduces variability. The same triggers fire at every location. The same message templates apply to every department. This consistency creates trust. Patients know what to expect regardless of where they receive care.

Consistent triggers and messaging eliminate location-based differences. For instance, a patient who pays a co-pay at Location A receives the same communication style when they visit Location B. This uniformity reinforces that they're interacting with one health system, not multiple independent clinics.

Predictable patient experience builds confidence in the system. When payment processes work the same way every time, patients develop trust. They know a text message will arrive after each visit. They know the payment link will work.

Improved trust extends beyond billing. When patients see that a health system operates in an organized, consistent manner, they trust clinical operations more as well. Billing consistency signals overall system competence.

Central oversight of workflows ensures compliance and quality. Leadership sets the rules for payment communication. They approve message templates. They determine timing parameters. This governance protects patients and maintains standards.

Local execution at scale happens automatically once workflows are configured. Individual locations don't need to implement their own systems. The central workflow applies everywhere. This approach scales efficiently as the health system grows.

Balanced control maintains quality while enabling speed. Centralized governance prevents chaos. Automated execution ensures quick action. Together, these elements create a payment system that works reliably across large, complex health networks.

Payment messages may reference PHI. A text that says "your balance from your January 10 visit with Dr. Smith is $85" contains protected health information. It reveals that the patient saw a specific doctor on a specific date. Enterprise systems require secure handling of this data.

Enterprise systems require secure handling of all patient data. HIPAA regulations apply to payment communication just as they apply to clinical communication. Health systems must use compliant platforms that encrypt messages and protect patient privacy.

Secure delivery protects patient information in transit and at rest. HIPAA-compliant texting platforms encrypt messages so they can't be intercepted. They also store message history securely for audit purposes.

Controlled access ensures only authorized users can send payment messages. Staff need proper credentials to access the payment workflow system. Role-based permissions prevent unauthorized users from viewing patient balance information.

Reduced risk of data exposure comes from using purpose-built healthcare communication platforms. Generic texting services don't meet HIPAA standards. Healthcare-specific platforms include business associate agreements, encryption, and audit logging.

Centralized payment communication records make audits easier. When all payment messages flow through one system, compliance teams can review communication history quickly. They can verify that only appropriate information was shared and that messages went to the correct patients.

Clear accountability follows from documented workflows. Audit logs show who configured the workflow, when messages went out, and which patients received them. This transparency supports compliance reviews.

Compliance-ready documentation helps health systems respond to regulatory inquiries. If a patient files a privacy complaint, the system can quickly produce records of all communication sent to that patient. This documentation protects the health system and demonstrates compliance.

Built for enterprise healthcare environments, Curogram understands the complexity of health system operations. The platform supports high-volume messaging, multi-location coordination, and centralized governance. It's designed specifically for healthcare, not adapted from consumer messaging tools.

Health systems that send 10,000 payment messages monthly need reliable infrastructure. Curogram handles this volume easily while maintaining message delivery speed and system responsiveness.

Aligns collections with operational workflows so payment communication integrates with existing systems. Curogram connects to Oracle Health and other EHR platforms. This integration allows workflows to trigger based on actual patient encounters, not manual data entry.

Predictable delivery ensures payment messages reach patients at the right time. Curogram's workflow engine monitors patient encounters and triggers messages based on configured rules.

Pre-visit co-pays go out 48 hours before appointments. Post-visit balances send within 24 hours of service. Follow-ups happen on schedule without staff intervention.

Scalable performance supports growth. As health systems add locations or increase patient volume, Curogram scales automatically. There's no need to rebuild infrastructure or reconfigure complex settings. The platform grows with the organization.

Enterprise-ready governance gives leadership control over payment communication. Revenue cycle teams configure workflows centrally. They approve message templates. They set timing parameters. Individual locations execute these workflows automatically, maintaining consistency while enabling scale.

Enterprise payment-collection workflows for Oracle Health teams deliver measurable results. Standardized processes replace fragmented billing outreach.

Automated text messages reduce call volume by 50-60%. Collections speed up when patients receive clear payment requests within 24 hours of service.

Text-to-pay isn't just a communication tool. It's revenue cycle infrastructure that works reliably at health system scale.

Like EHR systems standardize clinical documentation, payment workflows standardize billing communication. This infrastructure supports growth without adding staff.

Oracle Health systems ready to modernize payment operations should evaluate their current billing communication processes. Map out how payment requests happen today.

How Curogram Integrates Automates Payment Workflows in Oracle Health

Curogram transforms payment collection from a manual task into reliable infrastructure. The platform connects directly to Oracle Health systems, pulling patient encounter data automatically. This integration eliminates manual data entry and ensures payment messages trigger at the right time for every patient.

The workflow engine sits at the heart of Curogram's payment solution. Revenue cycle teams build workflows using simple rules: "Send a co-pay reminder 48 hours before appointments" or "Send balance notifications 24 hours after discharge." Once configured, these workflows run automatically across all locations and departments.

Message templates maintain consistency while allowing customization. The central revenue cycle team creates approved templates with standardized language and tone.

Individual departments can customize service line names or provider details without changing the core message structure. This balance ensures consistency without sacrificing relevance.

Real-time dashboards give leadership visibility into payment operations. They see how many messages went out today, which patients paid, and where bottlenecks exist.

HIPAA compliance is built into every feature. Curogram encrypts all messages, maintains secure audit logs, and provides business associate agreements. The platform meets healthcare's strict privacy standards without requiring complex configuration.

Integration with payment processors creates a seamless experience. Patients click a payment link in their text message and land on a secure payment page. They enter payment details once and complete the transaction. The payment posts to their account automatically.

Curogram also supports exception handling. When a patient responds to a payment message with a question, staff receive an alert. They can continue the conversation within the platform, maintaining context and providing personal service when needed.

Enterprise payment-collection workflows change how Oracle Health teams manage billing communication. Instead of manual calls and fragmented outreach, workflows create a standardized system that works reliably at scale.

The benefits extend across the organization. Staff spend less time on repetitive tasks and more time on complex cases. Billing call volume drops by 50-60% in most implementations.

Collections speed up because patients receive timely payment requests with clear action steps. Patient satisfaction improves because the billing process becomes predictable and transparent.

Implementing payment workflows requires upfront effort. Revenue cycle teams must define trigger rules, create message templates, and configure system integrations.

But this investment pays back quickly. Most Oracle Health systems see positive ROI within 3-6 months through reduced labor costs and faster collections.

The key is starting with clear goals. What percentage of billing calls do you want to eliminate? How quickly should patients receive payment requests after visits? What message tone best fits your organization's culture? Answer these questions before building workflows.

Success also requires staff buy-in. Billing teams need to understand that automation helps them, not replaces them. Workflows handle routine cases so staff can focus on complex situations that need human judgment.

Payment workflows work best as part of broader healthcare communication workflows. The same platform that sends payment requests can send appointment reminders, test results, and care instructions.

Oracle Health teams ready to modernize payment collection should start by evaluating their current process. Map out how billing communication happens today. Identify pain points. Then design workflows that address those specific challenges.

With the right approach, automated payment collection becomes reliable infrastructure that supports both operations and patient experience.

Ready to modernize your payment collection process? Book your demo today to learn how Curogram builds reliable infrastructure that supports both operations and patient experience in Oracle Health.

Post-visit payment messages work best when sent within 24 hours of service. Patients remember their visit clearly and understand the charges better. This timing improves payment rates compared to messages sent days or weeks later when the visit feels distant.

Text messages let patients act immediately by clicking a payment link. Phone calls often go to voicemail and require callbacks. Texts also provide a written record patients can reference later. For balances under $500, text-to-pay typically outperforms phone outreach by 40-50%.

HIPAA-compliant platforms encrypt all messages and maintain secure audit logs. Role-based access controls limit who can send messages. Centralized governance ensures approved message templates don't include excessive PHI. Business associate agreements formalize the compliance relationship between health systems and communication vendors.

💡 For Athenahealth users, text-to-pay collections offer a faster and more secure billing process. Mobile payments are also a patient-friendly way...

💡 Text-to-pay in Veradigm helps imaging centers collect payments faster and reduce admin work. This mobile payment method sends secure links...

💡 Text-to-pay changes how imaging centers handle billing. This system lets centers collect payments from Veradigm users through simple text links.