Improving Cash Flow and Revenue with Text-to-Pay in Veradigm

💡 Text-to-pay helps imaging centers improve cash flow with Veradigm by speeding up payment collection. It cuts down the time patients take to pay...

Table of Contents

Medical billing shouldn't feel like a puzzle for patients to solve. Yet many practices still rely on paper statements and clunky patient portals. These old methods create friction that delays payments and frustrates everyone involved.

Meditab IMS practices handle high patient volumes across ambulatory and community care settings. When payment processes slow down, the ripple effects hit hard. Billing teams spend hours making follow-up calls. Patients miss due dates because they can't find login credentials. Cash flow becomes unpredictable, making it harder to plan and invest in better care.

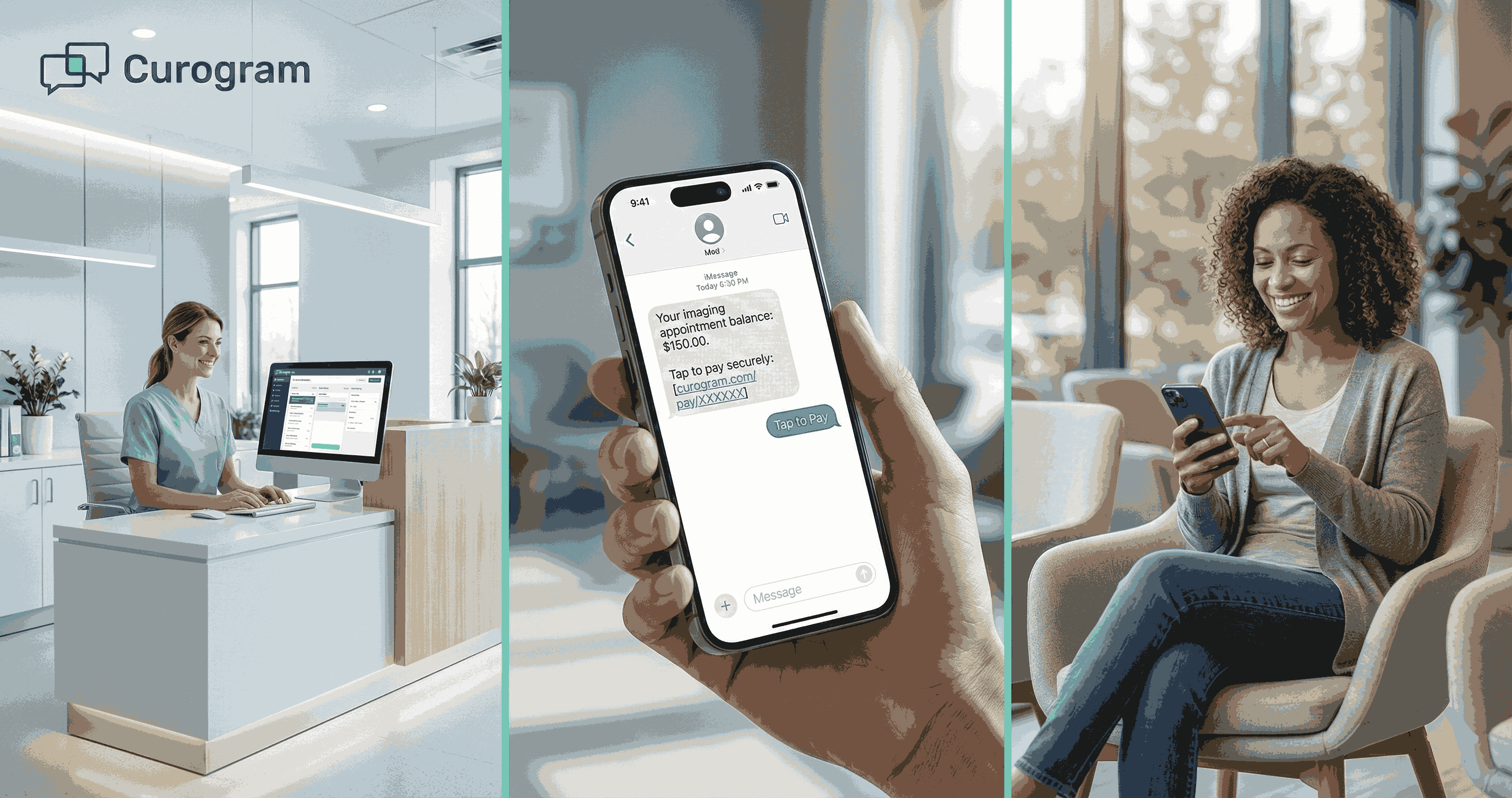

Text-to-pay for Meditab IMS practices offers a better path forward. This payment method delivers secure links directly to patients' phones. No apps to download. No passwords to remember. Just a simple text message with a link that takes seconds to complete.

The shift to text-based payments isn't just about convenience. It's about removing the barriers that keep patients from paying on time. When you make payments easy, patients respond faster. When patients respond faster, your revenue cycle runs smoother.

Consider how people handle most tasks today. They use their phones for banking, shopping, and scheduling appointments. Payment for medical services should work the same way. Text-to-pay meets this expectation while maintaining the security and compliance standards healthcare requires.

This approach transforms patient access workflows and revenue cycle workflows. Billing teams automate routine payment requests. Patients receive clear, timely messages about what they owe. The result is fewer delays, less manual work, and more predictable revenue.

For Meditab IMS practices juggling complex schedules and diverse patient populations, text-to-pay simplifies one of healthcare's most persistent challenges. The technology integrates with existing systems without disrupting daily operations. Staff adoption is quick because the process is intuitive.

The following sections explore how text-to-pay addresses specific pain points in medical billing. You'll see how this tool reduces friction, improves collection rates, and gives your team more time to focus on patient care instead of payment follow-ups.

Payment delays create a domino effect across medical practices. When patients put off paying, practices face staffing strain and financial uncertainty. Understanding why these delays happen is the first step toward fixing them.

Patients don't usually delay payments out of malice. Most delays stem from friction in the payment process itself. Traditional billing methods demand extra steps that patients often skip or forget. A paper statement arrives in the mail, sits on the kitchen counter for days, and eventually gets buried under other mail. Patient portals require usernames and passwords that patients rarely remember after their first login attempt.

These barriers seem small on their own. Together, they create significant obstacles that prevent timely payment. When patients face too many steps between receiving a bill and completing payment, they postpone the task. Days turn into weeks, and what started as a simple payment becomes a collections issue requiring staff intervention.

Billing teams bear the brunt of this friction. They spend valuable time making phone calls to patients about overdue balances. Each call takes several minutes, and many patients don't answer on the first attempt. Multiple follow-up calls become necessary, consuming hours that could be spent on more complex billing matters or patient support.

Text-to-pay for Meditab IMS practices cuts through this friction directly. The payment link arrives where patients already spend their time—on their phones. One tap opens a secure payment page. Another few taps complete the transaction. The entire process takes less time than finding a checkbook or logging into a portal.

Revenue cycle efficiency depends on how quickly payments move from service delivery to collection. Every day of delay affects financial planning and operational capacity. Payment friction creates three main problems that compound over time.

Slower collections hit first. When patients take weeks instead of days to pay, the gap between service and payment widens. This delay affects how quickly practices can cover operational costs, pay staff, and invest in equipment or technology. The longer money stays outstanding, the harder it becomes to maintain consistent operations.

Increased follow-up workload comes next. Billing staff must track which patients haven't paid, when to send reminders, and how many attempts have been made. This tracking requires attention to detail and time that could be used elsewhere. Phone calls, emails, and additional statements all require labor hours. When friction causes more patients to delay, the workload multiplies across the entire patient base.

High-volume practices feel this burden most acutely. With hundreds or thousands of patient encounters monthly, even small friction points create massive administrative overhead.

Unpredictable cash flow creates the biggest long-term challenge. Practices need reliable revenue projections to make smart business decisions.

When payment timelines stretch and vary widely, forecasting becomes guesswork. Leadership can't confidently approve new hires, equipment purchases, or facility improvements without knowing when outstanding balances will convert to actual revenue.

This unpredictability also affects relationships with vendors and creditors. Practices with erratic cash flow may struggle to negotiate favorable payment terms or secure financing for growth initiatives. Financial instability, even if temporary, limits strategic options.

Text-to-pay addresses these issues by shortening the time between billing and payment. When patients receive payment requests via text immediately after a visit or when a balance comes due, they can act right away.

The reduced friction means more patients pay on their first attempt, without needing follow-up. This pattern creates more predictable revenue cycles and reduces the administrative burden on billing teams.

The shift from paper-based or portal-based billing to text-based payment isn't just a minor process improvement. It represents a fundamental rethinking of how patient access workflows and revenue cycle workflows should function in a mobile-first world.

By eliminating unnecessary steps and meeting patients on their preferred communication channel, practices see measurable improvements in collection speed and staff efficiency.

Patient satisfaction extends beyond clinical care into every interaction with your practice. Payment experiences shape how patients feel about your organization. When billing feels difficult or confusing, it colors their entire perception of your practice.

Traditional payment methods often fail the convenience test. Patients receive paper statements days after their visit. By the time the bill arrives, they've moved on mentally from the appointment. The statement may lack a clear context about what the charges cover, leading to confusion and inaction.

Patient portals were meant to solve these problems, but they introduced new ones. Many patients create portal accounts during registration but never log in again. Password resets become a barrier. Multiple clicks through security questions and verification steps add friction. Some patients give up entirely rather than navigate these hurdles.

Text-to-pay for Meditab IMS practices removes these obstacles. The payment request arrives as a text message on the patient's phone. No separate app or account required. The message includes basic information about the balance and a secure link to complete payment. This simplicity drives higher completion rates and better patient experiences.

Mobile phones have become the primary device for most online activities. People check their phones dozens of times daily. Text messages get read within minutes of arrival. This immediate visibility gives text-to-pay a massive advantage over other billing methods.

The payment process itself requires minimal effort. Patients click the link in the text message, which opens a mobile-friendly payment page. They enter or select their payment method, confirm the amount, and submit. The entire transaction takes under a minute for most patients. This speed and ease encourage immediate action rather than postponement.

Mobile-friendly payment links adapt to different screen sizes and devices. Whether a patient uses a smartphone or tablet, the payment interface displays clearly and functions smoothly. No zooming or horizontal scrolling required. The streamlined design keeps the focus on completing the payment quickly.

Reducing Payment Abandonment

Payment abandonment happens when patients start the payment process but don't finish. This typically occurs when the process becomes too complex or time-consuming.

Faster completion rates benefit both patients and practices. Patients appreciate being able to handle their balance immediately, without adding another task to their to-do list. Practices benefit from quicker cash conversion and fewer outstanding balances requiring follow-up. The reduced friction in patient access workflows creates a win-win scenario.

Supporting Patients After Visits

Timing matters in payment collection. The closer the payment request comes to the actual visit, the more context patients have about the charges. Text-to-pay enables practices to send payment requests shortly after care delivery, while the visit remains fresh in patients' minds.

Timely payment requests reduce confusion. When patients receive a bill weeks after a visit, they may question what the charges represent. Immediate or next-day payment requests connect directly to the recent visit, making the charges clear and easier to process mentally. This clarity reduces the number of billing questions staff must answer.

Clear balance context helps patients understand what they owe and why. The text message can include basic details like the visit date and remaining balance after insurance processing. Some systems allow for brief descriptions of services rendered. This transparency builds trust and encourages prompt payment.

Patients also appreciate the flexibility text-to-pay provides. If they can't pay immediately, the link remains active. They can return to it later when convenient, without needing to search through email or paper files. The message stays in their phone's text history, making it easy to find when they're ready to pay.

The improved patient payment experience creates positive spillover effects. Satisfied patients are more likely to recommend your practice to friends and family. They're also more likely to return for future care needs. By smoothing out payment friction, practices strengthen patient relationships while improving revenue cycle workflows.

Billing departments spend substantial portions of their day on patient outreach. Phone calls to patients with outstanding balances consume time and energy. These calls rarely feel productive, especially when patients don't answer or promise to pay later but don't follow through. The repetitive nature of this work contributes to staff burnout and reduces overall team efficiency.

Manual billing outreach creates several hidden costs beyond the obvious time expenditure. Staff must maintain detailed records of each contact attempt. They need to track which patients were called, when the call occurred, what was discussed, and whether a payment plan was arranged. This documentation is necessary for compliance and collections purposes, but it adds layers of administrative work.

The emotional toll on billing staff shouldn't be underestimated. Making collection calls is one of the least popular tasks in medical offices. Staff members must remain professional while discussing sensitive financial topics with patients who may be defensive, frustrated, or struggling financially. This stress accumulates over time and affects job satisfaction and retention.

Automation through text-to-pay for Meditab IMS practices addresses these challenges directly. By automating routine payment requests, practices reduce the volume of manual outreach needed. Staff can shift their focus to more complex cases that genuinely require human intervention and problem-solving skills.

Phone calls have been the primary method for billing follow-up for decades. While they allow for direct communication, they're also inefficient. Many calls go to voicemail. Patients may not return calls promptly, requiring additional attempts. Each successful call typically lasts several minutes, limiting how many patients one staff member can contact in a day.

The math is straightforward but sobering. If each collection call takes five minutes and only half of patients answer on the first attempt, a billing staff member might successfully speak with twelve patients per hour. Multiple attempts for non-answers add further time. For practices with hundreds of outstanding balances, comprehensive outreach becomes practically impossible.

Paper statements face different but equally significant limitations. Printing, folding, stuffing envelopes, and postage all cost money. More importantly, paper statements have low response rates. Many patients don't open medical bills immediately. Some statements get lost in the mail or thrown away accidentally. The delayed delivery means patients receive bills days after they're sent, extending the payment timeline.

Fewer outbound calls mean billing teams have more time and energy for value-added work. Instead of spending hours leaving voice messages, staff can focus on resolving billing disputes, setting up payment plans for patients with financial hardship, or working through complex insurance issues that require specialized knowledge.

Calculating Cost Savings

Consider a practice that reduces collection calls by 60% through text-to-pay adoption. If billing staff previously spent twenty hours weekly on collection calls, that's twelve hours freed up for other priorities.

Reduced mailing costs provide immediate budget relief. Postage, paper, envelopes, and printer supplies add up quickly across hundreds of statements monthly. Many practices spend thousands of dollars yearly on statement production and mailing. Text-to-pay eliminates most of this expense while delivering messages more quickly and effectively.

Not all billing situations are straightforward. Some cases require detailed investigation, negotiation, or creative problem-solving. These complex cases deserve the full attention of skilled billing professionals. Unfortunately, when staff are buried in routine collection tasks, complex cases often don't get the attention they need.

More time for complex cases improves overall revenue recovery. Insurance denials, coordination of benefits issues, and disputed charges require careful review and strategic responses. When billing staff can dedicate proper time to these situations, resolution rates improve. This focused attention often recovers revenue that might otherwise be written off.

Text-to-pay handles routine collections automatically, freeing staff to work on cases where their expertise makes a real difference. A patient with a straightforward $75 copay balance can pay via text without staff involvement. Meanwhile, billing specialists can work on a $5,000 insurance appeal that requires documentation review and phone calls to the payer.

The distinction between routine and exceptional cases becomes clearer when automation handles the routine work. Staff can quickly identify which situations need human attention and which will resolve through automated processes. This clarity improves workflow efficiency and helps supervisors allocate resources effectively.

Billing work becomes more engaging when staff spend less time on repetitive tasks. Problem-solving and patient advocacy feel more meaningful than making the same collection call repeatedly.

Reduced staff stress is another significant benefit. Collection work can be draining, especially when patients become angry or defensive about bills. While these conversations will still occur for complex situations, their frequency decreases when routine payments happen automatically. Staff report higher job satisfaction when their work involves more variety and less emotional labor.

The improved work environment helps with retention. Medical billing professionals with strong skills are in high demand. Practices that create better working conditions through automation and process improvement have an easier time keeping talented staff. The cost savings from reduced turnover and recruitment expenses add to the financial benefits of text-to-pay adoption.

When billing teams can focus on exceptions, the quality of patient interactions improves as well. Staff have more time to explain charges clearly, discuss payment options, and work out arrangements with patients facing financial difficulty. These personalized interactions build better patient relationships and often lead to better payment outcomes than automated reminders alone could achieve.

The combination of automated routine collection and human attention for complex cases creates an optimal billing operation. Technology handles what it does best—consistent, timely, scalable communication. Humans handle what they do best—nuanced problem-solving, empathy, and negotiation. This division of labor benefits everyone involved in patient access workflows and revenue cycle workflows.

Financial stability requires knowing when revenue will arrive. Medical practices operate on tight margins with significant fixed costs. Staff salaries, rent, equipment leases, and supply orders all demand reliable cash flow. When payment timelines stretch unpredictably, financial planning becomes difficult and stress increases.

Traditional billing creates variable payment patterns. Some patients pay immediately upon receiving a statement. Others wait until a second or third notice. Some never pay without direct contact from billing staff. This variability makes it hard to project monthly revenue accurately or know how much outstanding balance will actually convert to collected payments.

Faster payments improve revenue visibility. When most patients pay within days of service rather than weeks, practices can project cash flow with greater confidence. This predictability enables better decision-making about investments, staffing levels, and strategic initiatives. Financial leadership can plan with actual data rather than estimates and hopes.

The gap between service delivery and payment collection varies widely across billing methods. Paper statements introduce built-in delays—production time, mail delivery, patient review, and payment processing all add days or weeks. Even electronic statements sent via patient portals often sit unread for extended periods.

Text-to-pay for Meditab IMS practices compresses this timeline significantly. Payment requests can be sent the same day as service or shortly after insurance processing completes. Patients receive the message immediately and can pay within minutes. Many practices report average collection times dropping from thirty days to less than ten days after implementing text-to-pay.

Quicker patient response rates drive this improvement. When patients receive a text message, they typically read it within a few minutes. The immediate visibility prompts action. Compare this to paper statements that might sit unopened for days or email statements that get buried in cluttered inboxes.

Reduced delays compound over time. When each billing cycle shortens by two weeks, the practice gains nearly a month of cash flow improvement over the course of a quarter. This acceleration means having funds available sooner for operational needs, reducing reliance on credit lines or reserves.

Revenue consistency matters as much as revenue total. A practice that collects $100,000 monthly on a predictable schedule can plan more effectively than one that collects $90,000 one month and $110,000 the next, even though the average is similar.

Predictable inflows allow for smarter resource allocation. When leadership knows revenue will arrive reliably, they can commit to investments that improve patient care or practice efficiency. New equipment purchases, staff training programs, or facility upgrades all become easier to justify and finance.

Improved financial planning extends beyond month-to-month operations. Annual budgets become more accurate when based on reliable payment patterns. Strategic planning for practice growth or expansion relies on confident revenue projections. Text-to-pay contributes to this confidence by creating more consistent collection patterns.

The benefits extend to banking relationships as well. Lenders and financial institutions view practices with stable cash flow more favorably. Better credit terms, lower interest rates, and increased borrowing capacity often follow when a practice demonstrates consistent revenue collection.

Technology only delivers value when it fits smoothly into existing operations. Medical practices can't afford workflow disruptions that slow down patient care or create staff confusion. Text-to-pay must work within established patient access workflows and revenue cycle workflows to be effective.

Payment workflows should align with scheduling and care delivery patterns. A text-to-pay system needs to trigger payment requests at the right time based on appointment types, insurance status, and practice policies. This alignment ensures patients receive payment requests when they make sense, not randomly or too frequently.

Different visit types require different billing approaches. In-person visits often involve copays collected at check-in, with remaining balances billed after insurance processing. Virtual visits may handle payment entirely after the fact, since there's no physical check-out process. Text-to-pay must accommodate both scenarios seamlessly.

Post-visit payments work well for balances after insurance. Once the practice receives the explanation of benefits from the insurance company, staff can trigger a text-to-pay message for the patient's responsibility. This timing provides clarity about what the patient owes and why, reducing confusion and disputes.

Telehealth billing presents unique challenges. Without an in-person interaction, practices have fewer opportunities to discuss payment. Text-to-pay fills this gap by providing a convenient way to request payment after virtual appointments. The message can reference the telehealth visit specifically, helping patients connect the payment to the service received.

Manual payment request processes don't scale effectively. As patient volumes grow, staff can't keep up with individual outreach. Automation becomes essential for maintaining efficiency without proportional increases in billing staff.

Trigger-based messages send payment requests automatically based on predefined criteria. Common triggers include appointment completion, insurance adjudication, or specific time intervals after service. These automated triggers ensure every patient receives timely payment requests without requiring staff to manually initiate each one.

Consistent workflows reduce errors and oversights. When payment requests follow standard rules, patients receive reliable, predictable communication. Staff don't need to remember different protocols for different situations. The system handles routine cases automatically, flagging only exceptions that need human review.

Healthcare organizations must protect patient information in every interaction. Payment communications present particular compliance challenges because they often reference medical services or patient account details. Any payment system must meet strict security standards to avoid violations that carry severe penalties.

Payment messages may include sensitive information like visit dates, service types, or account balances. Even seemingly innocuous details can reveal protected health information when combined with other data points. A message stating "Your balance from your January 10th cardiology visit is $150" confirms both that the patient saw a cardiologist and when the visit occurred.

HIPAA regulations require specific safeguards for all electronic communications containing protected health information. These safeguards include encryption, access controls, and audit trails. Text messaging systems used for payment requests must implement these protections or structure messages to avoid transmitting protected information through unsecured channels.

Non-compliance risks extend beyond regulatory fines. Data breaches damage patient trust and practice reputation. Patients expect their health information to remain private. Any breach, even unintentional, can lead to patient attrition, negative reviews, and long-term harm to practice brand.

Secure delivery forms the foundation of compliant payment messaging. HIPAA-compliant text-to-pay systems encrypt messages during transmission and storage. This encryption ensures that even if messages are intercepted, the content remains unreadable to unauthorized parties.

Protected patient data requires careful handling throughout the payment process. Compliant systems minimize the amount of detailed information included in text messages themselves. Instead, messages typically contain generic payment requests with a secure link. The link leads to an encrypted portal where patients can view full details after authentication.

This approach balances convenience with security. Patients receive simple text notifications that payment is due, with minimal detail that could expose protected information. When they click the link, they access a secure environment where appropriate safeguards protect their data. The two-step process maintains security without sacrificing the ease of mobile payments.

Authentication mechanisms verify patient identity before displaying sensitive information. These may include date of birth verification, the last four digits of a social security number, or system-generated security codes. Multi-factor authentication adds extra protection for high-risk transactions or first-time users.

Healthcare organizations must document their compliance efforts. Auditors and regulators expect to see evidence that proper safeguards are in place and functioning as intended. Payment communication systems should support these oversight needs through comprehensive logging and reporting capabilities.

Centralized payment records create a single source of truth for billing activity. When all payment communications and transactions flow through one system, compliance teams can easily review what messages were sent, when they were sent, and how patients responded. This centralization simplifies audits and reduces the risk of gaps in documentation.

Clear accountability helps identify and address compliance issues quickly. When problems occur—a message sent to the wrong number, unauthorized access attempts, or system vulnerabilities—centralized logging reveals what happened and when. Teams can respond promptly to contain any damage and prevent recurrence.

Regular compliance reviews should examine payment communication practices alongside other HIPAA-covered activities. These reviews verify that encryption remains current, access controls function properly, and staff follow established protocols. Documentation from these reviews demonstrates due diligence to regulators.

Business associate agreements are necessary when third-party vendors provide text-to-pay services. These agreements formally establish the vendor's responsibility to maintain HIPAA compliance and specify the safeguards required. Practices should verify that their text-to-pay provider offers appropriate agreements and actually implements promised protections.

Staff training ensures everyone understands their role in maintaining compliance. Billing team members should know what information can be included in payment messages and what should remain behind secure authentication. Regular training updates keep staff informed about policy changes and emerging threats.

Medical practices need payment solutions built specifically for healthcare workflows. Generic payment systems don't understand the unique requirements of ambulatory and community care settings. Curogram designs text-to-pay for Meditab IMS practices with these specific needs in mind.

The system integrates smoothly with existing Meditab IMS environments. Setup doesn't require extensive IT work or disruption to daily operations. Practices can begin sending payment requests quickly, without lengthy implementation timelines or complex technical configuration.

Ease of use matters for both patients and staff. Patients appreciate the simple, one-tap payment process. Staff value the intuitive interface that requires minimal training. When technology feels natural and straightforward, adoption happens quickly and resistance remains low.

Compliance and scale represent core design principles. Every feature reflects HIPAA requirements and the operational demands of busy medical practices. As patient volumes grow, the system scales seamlessly without performance degradation or additional complexity.

Centralized oversight gives practice leadership visibility into payment operations. Administrators can monitor payment request volume, completion rates, and outstanding balances from a single dashboard. This visibility supports data-driven decisions about billing policies and processes.

Reliable delivery ensures payment requests reach patients consistently. Message delivery failures create gaps in revenue cycle workflows that can be hard to detect and resolve. Curogram's infrastructure prioritizes delivery reliability, with automatic retry logic and failure notifications when issues occur.

The platform supports the full range of payment scenarios Meditab IMS practices encounter. From routine copays after primary care visits to complex specialty billing with multiple insurance layers, the system adapts to different needs. Flexible configuration options allow practices to customize message timing, content, and follow-up sequences.

Integration with patient access workflows means payment requests align with scheduling, visit completion, and insurance verification processes. This coordination eliminates manual steps and ensures patients receive payment communications at optimal times. Staff don't need to switch between multiple systems to manage billing communications.

Revenue cycle workflows benefit from automation that handles routine cases while flagging exceptions for staff review. The system identifies patterns that might indicate problems—repeated non-payment, disputed charges, or technical issues. These alerts help billing teams address issues proactively before they escalate.

Payment friction creates unnecessary challenges for medical practices and patients alike. When paying feels difficult, everyone loses. Patients face frustration trying to navigate complex portals or track down paper statements. Practices deal with delayed revenue, increased staff workload, and unpredictable cash flow.

Text-to-pay for Meditab IMS practices offers a direct solution to these problems. By delivering secure payment links via text message, practices remove the barriers that slow down collections. Patients can pay in seconds from their phones, without logging into portals or searching for account numbers. This simplicity drives faster payment completion and higher patient satisfaction.

The benefits extend throughout the organization. Billing teams spend less time on manual follow-up calls and paper statement production. Staff can focus on complex cases that require human expertise and judgment. Revenue arrives faster and more consistently, improving cash flow predictability and financial planning.

Integration with existing patient access workflows and revenue cycle workflows ensures text-to-pay fits naturally into daily operations. The technology works within established processes rather than requiring practices to redesign workflows around new tools. This compatibility makes adoption smooth and minimizes disruption.

Compliance remains paramount in all healthcare communication. Text-to-pay systems built for medical practices include the security features and documentation capabilities HIPAA requires. Practices can improve collection efficiency without compromising patient privacy or exposing themselves to regulatory risk.

The shift to text-based payments reflects broader changes in how people communicate and conduct transactions. Patients expect mobile-friendly options in every aspect of their lives. Medical practices that meet these expectations create better patient experiences while improving their own operational efficiency.

For Meditab IMS practices looking to modernize billing operations, text-to-pay represents a practical first step. The technology is proven, implementation is straightforward, and results appear quickly. Practices typically see improvements in collection speed and staff efficiency within the first few months of adoption.

Book a demo to see how Curogram supports better care workflows with Meditab IMS.

Text-to-pay sends payment requests directly to patients' phones, where they're likely to see them within minutes. Patients can complete payment immediately by clicking the link, without needing to log into portals or mail checks.

This reduces the typical payment timeline from weeks to days. Most patients pay within 24-48 hours of receiving the text message.

Text messages don't require passwords, usernames, or separate apps to access. Patients receive the payment link directly in their text messages and can pay in under a minute.

Portal logins often frustrate patients who forget credentials or find navigation confusing. The simplicity of text-to-pay eliminates these friction points entirely.

Automated payment requests eliminate the need for staff to manually call or send statements to patients with routine balances. Staff time previously spent on collection calls can be redirected to complex billing cases requiring specialized attention. The system handles high-volume, straightforward payment requests while flagging exceptions for staff review.

HIPAA-compliant text-to-pay systems encrypt messages during transmission and minimize sensitive details in the initial text. Patients click a secure link that requires authentication before displaying account details or accepting payment. All communications and transactions are logged for audit purposes, maintaining the documentation trail HIPAA requires.

Implementation timelines vary by practice size and technical environment but typically range from a few days to a few weeks. Systems designed for Meditab IMS integrate smoothly with existing workflows without requiring extensive IT resources.

Staff training is minimal due to the intuitive interface. Many practices begin sending payment requests within their first week of system access.

💡 Text-to-pay helps imaging centers improve cash flow with Veradigm by speeding up payment collection. It cuts down the time patients take to pay...

💡 Text-to-pay in Veradigm helps imaging centers collect payments faster and reduce admin work. This mobile payment method sends secure links...

💡 Text-to-pay for Oracle Health systems helps large healthcare networks collect patient payments faster and reduce billing workload. This approach...