How Medstreaming Imaging Centers Automate Reputation Management

💡 Picture your billing specialist spending hours calling patients about overdue balances, only to reach voicemail. Text-to-Pay sends secure payment...

12 min read

.jpg) Mira Gwehn Revilla

:

Updated on February 10, 2026

Mira Gwehn Revilla

:

Updated on February 10, 2026

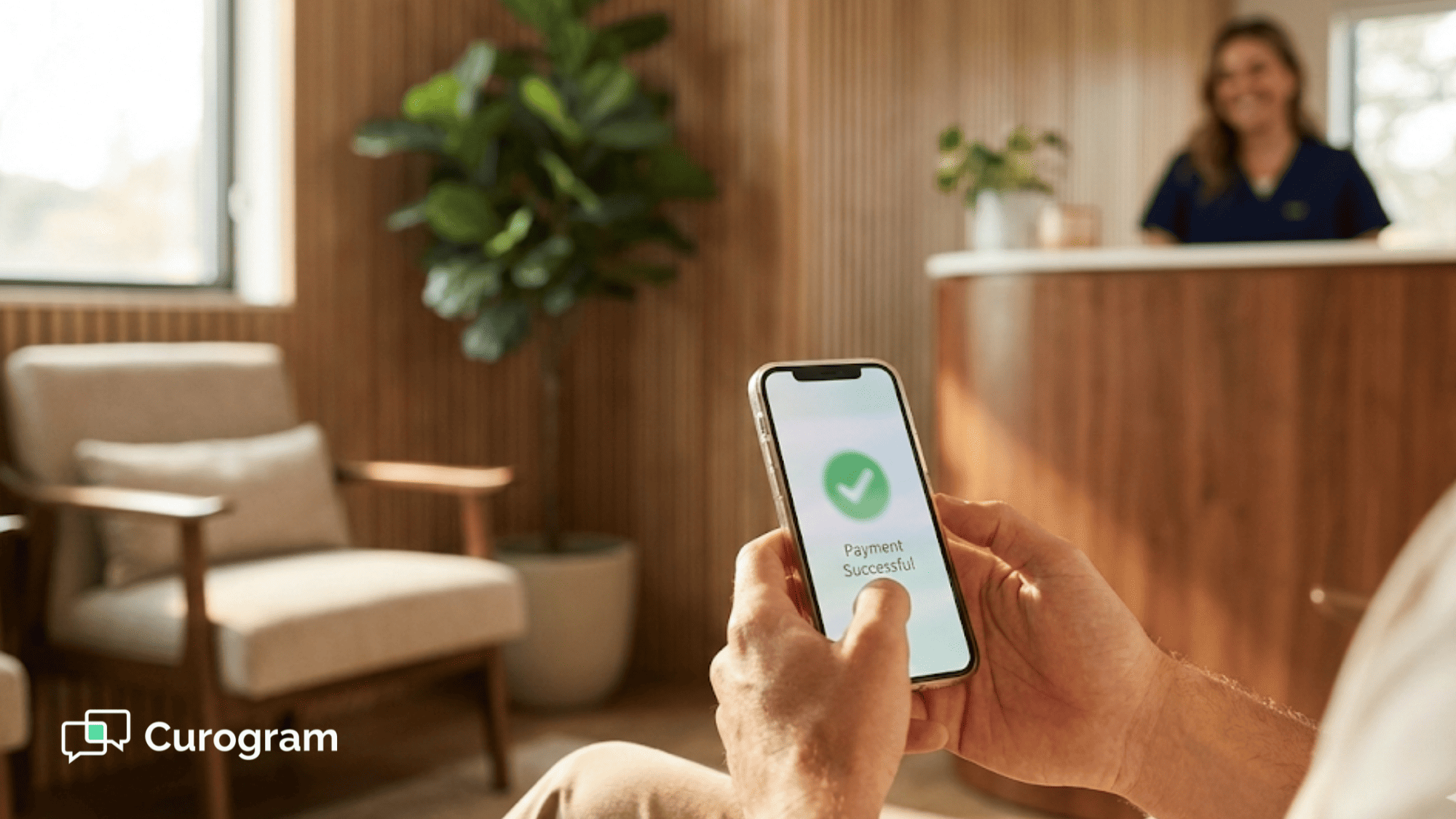

Picture this: A patient just finished a life-changing 90-minute consult with their doctor. The visit was warm, personal, and worth every dollar.

Then, they walk to the front desk and wait in line to swipe a card. Or worse, they go home and get lost trying to log into a clunky web portal from 2005. The premium feeling is gone in seconds.

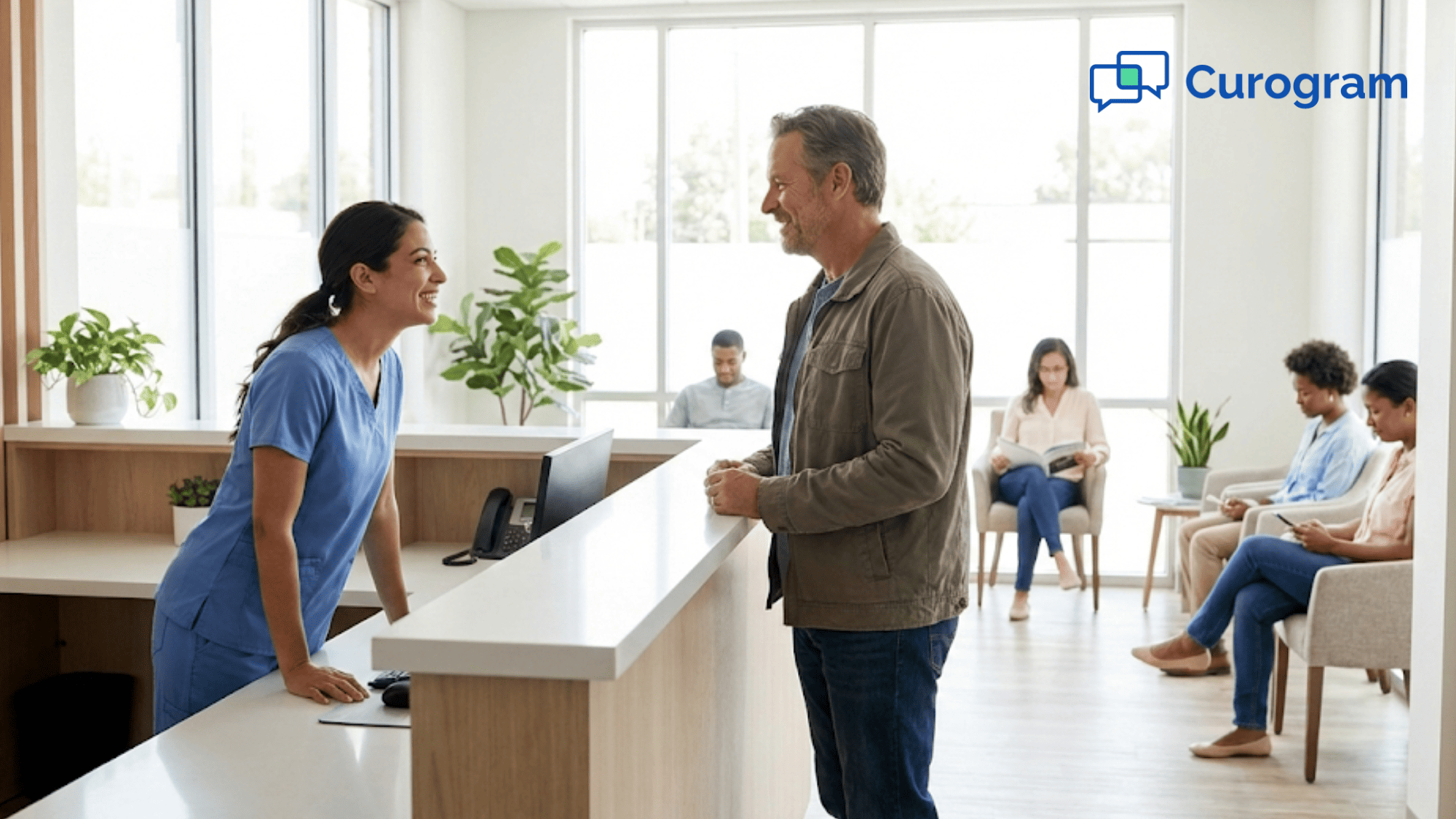

For boutique and cash-pay practices, every detail matters. Your patients are not just patients. They are clients who chose you for a reason.

They expect a concierge-level experience from check-in to checkout. But when the billing process feels stuck in the past, it damages your brand.

This is why frictionless medical billing for Cerbo has become so important for practices that use MD-HQ. The way your patients pay should feel as modern as the care you provide.

No more phone calls to read credit card numbers. No more portal passwords to reset. Just a simple, secure link sent right to their phone.

Think about how you order coffee or pay for a rideshare. One tap and you are done. Mobile patient payments bring that same ease to your practice.

Patients can settle their balance while sitting in their car or relaxing at home. They use Apple Pay, Google Pay, or a saved card. The whole thing takes seconds.

This article shows you how to build a billing workflow that matches the quality of your care. You will learn why old billing methods hurt your brand.

The goal is simple: Make paying for care as easy as getting the care itself.

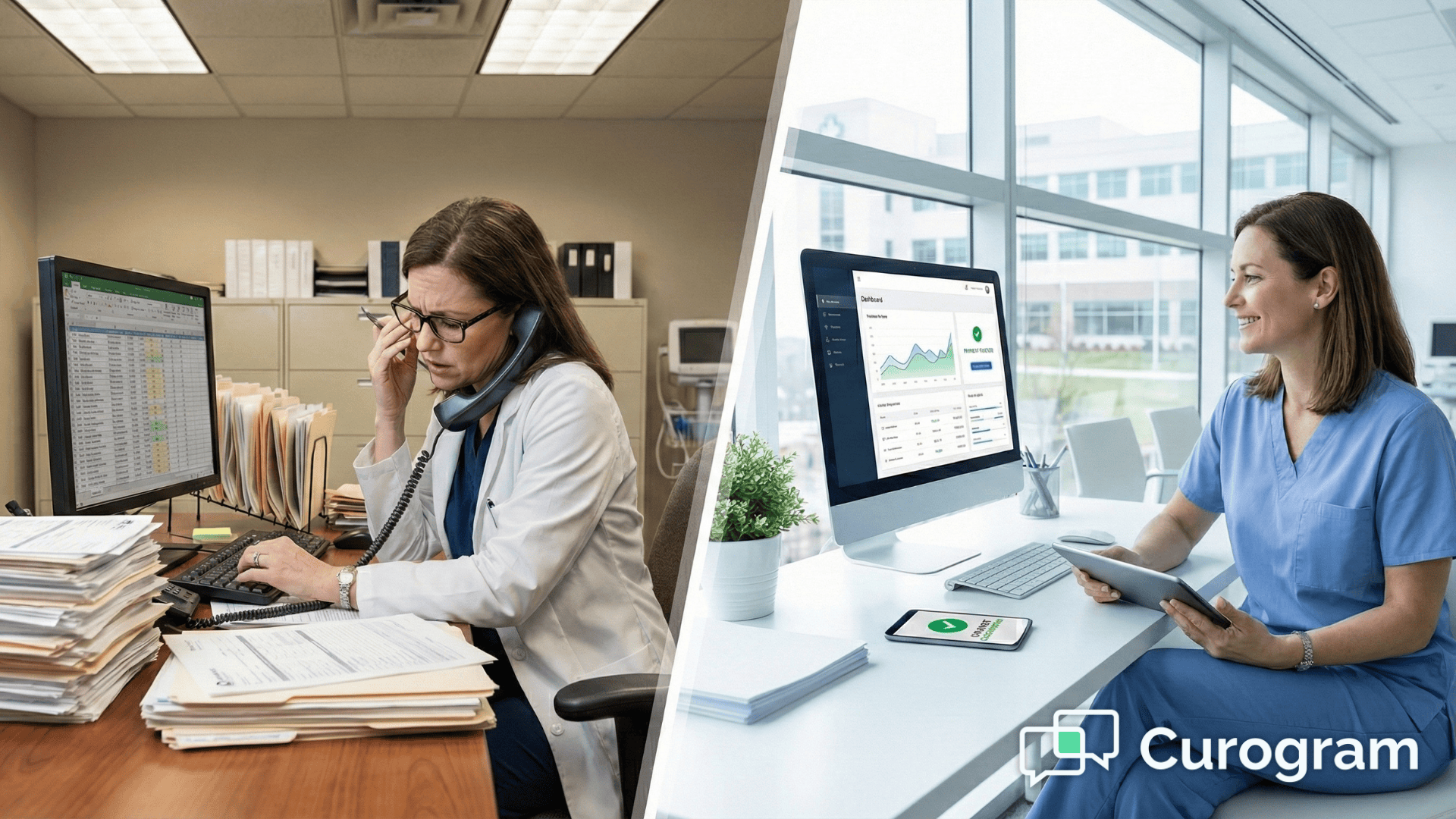

Your practice is not a factory. You do not rush patients through like widgets on a belt. You take time. You listen. You offer care that feels personal. But if the billing process does not match that level of service, you create what we call a "service gap."

This gap shows up in small ways that add up fast. And for a boutique practice patient experience, every moment counts.

Let us say a new patient books a consult at your practice. They pay a premium fee for your time. You spend an hour or more with them. You dig into their health history. You create a custom plan. They leave feeling hopeful and cared for.

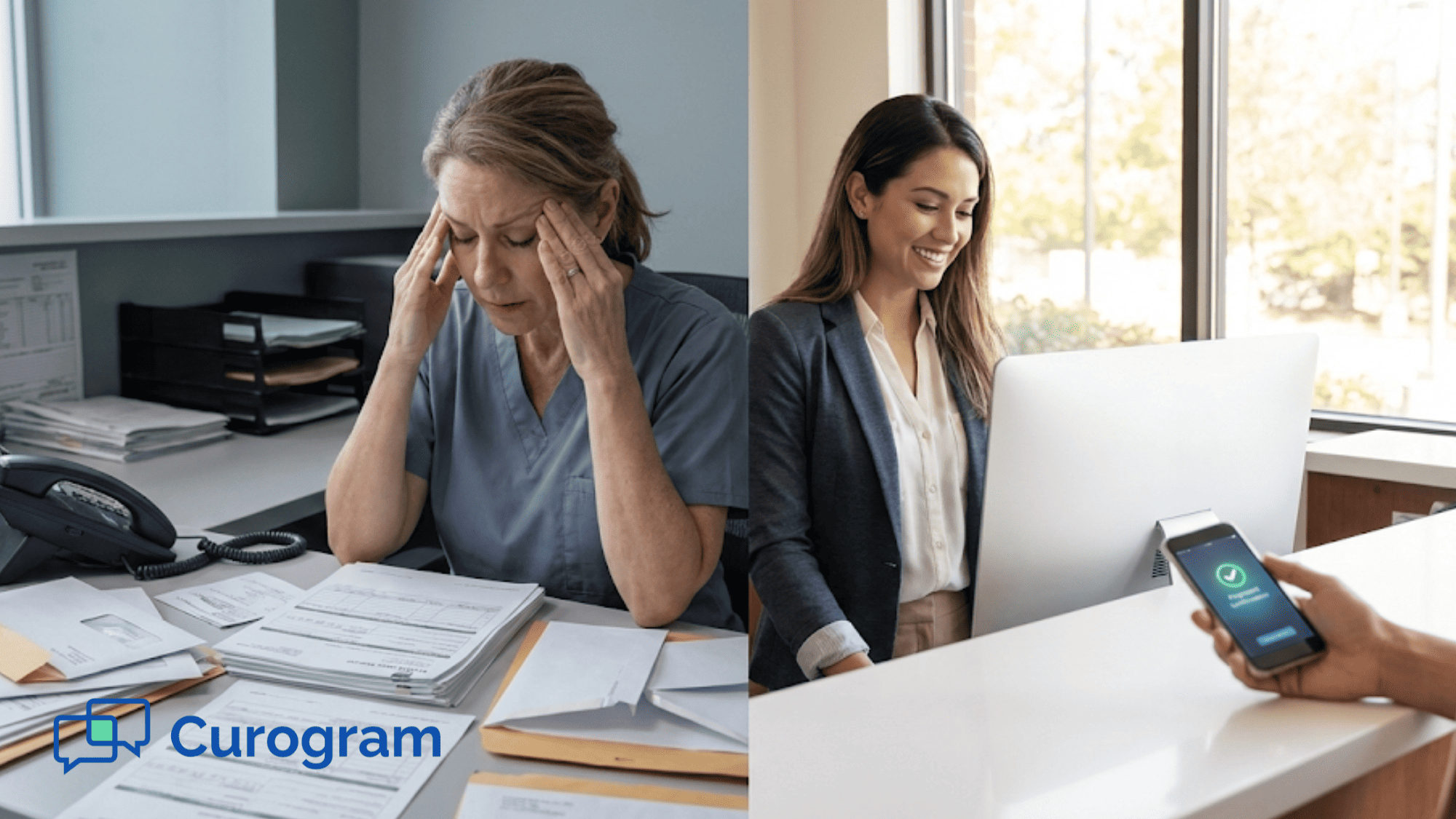

Then they get a paper invoice in the mail two weeks later. Or they get an email that sends them to a web portal they have never used.

They have to create an account. They have to remember a password. They have to click through five screens just to enter a card number.

All that goodwill you built? It starts to fade. The last taste in their mouth is not your amazing care. It is a clunky payment system that feels nothing like the rest of their visit.

This is the "penny-wise, pound-foolish" trap. You save a few dollars by using outdated tools. But you pay a bigger price in lost trust and repeat business.

Think about the end of a typical office visit. The patient finishes up and walks to the front desk. Maybe there is a line. Maybe your staff is on the phone with another patient. The wait stretches from one minute to five.

For a busy clinic, this is more than awkward. It creates a cold, rushed ending to what should be a warm visit. The patient goes from feeling cared for to feeling like just another task to process.

This bottleneck also eats up your staff's time. Instead of helping the next patient or handling urgent calls, they are running credit cards. They are printing receipts. They are stuck in a loop of low-value tasks that slow everything down.

With frictionless medical billing for Cerbo, you can skip this scene. Send the payment link before the patient even leaves. They tap their phone and pay from the parking lot.

Not all payments happen in the office. What about remote services like health coaching calls? What about supplement refills or lab fees?

In many practices, these payments turn into a headache. A patient calls to refill a supplement. Your staff has to pull up their record, quote a price, and ask them to read their card number over the phone.

The patient fumbles for their wallet. They read out 16 digits. Your staff writes it down on a sticky note.

This process is slow. It is awkward. And it is risky. Writing down card numbers creates a security gap. If that sticky note gets lost or seen by the wrong person, you have a problem.

Secure SMS payment links solve this. When a patient texts for a refill, your staff can reply with the price and a payment link. The patient taps, pays, and the order ships. Done in under a minute.

For practices that offer remote care, this is not a nice-to-have. It is a must. Your patients expect to pay for things on their phone.

They do it every day for food, rides, and shopping. When you bring that same ease to your practice, you show them that you value their time as much as they value yours.

The service gap is real. But closing it does not require a huge tech overhaul. It just takes the right tools and a focus on the patient experience.

A concierge service removes friction at every step. Think of a five-star hotel where staff handles the details so guests never have to ask. Your billing can work the same way. When you use text-to-pay for doctors, you turn payment into a seamless part of the care journey.

Here is how to build that workflow with Curogram and your Cerbo system:

Let us walk through a common scenario. A long-time patient sends a text to your office. They need a refill of their supplement protocol. In the old way, your staff would have to call them back, confirm the order, and take card details over the phone.

With secure SMS payment links, the flow looks different. Your staff sees the text come in. They pull up the patient's order in Cerbo.

They send a quick reply: "Hi Sarah, your refill is $75. Here is your secure payment link." Sarah taps the link, pays with one click, and gets a receipt right away. The order ships that same day. The total time for your staff is under two minutes. Likewise, the total friction for the patient is zero.

This approach works for many services beyond refills. Think health coaching sessions, lab fees, or custom protocol kits. Any time a patient owes money outside of an office visit, mobile patient payments make the process fast and easy.

Functional medicine and integrative care often involve long-term programs. A patient might be on a six-month protocol with lab work each month. In the past, you might have asked for full payment upfront or set up complex payment plans.

With frictionless medical billing for Cerbo, you can offer true pay-as-you-go flexibility. Each month, send a secure link for that month's fee. The patient pays when they are ready.

This approach helps patients who cannot pay thousands upfront. It also helps your cash flow stay steady. You do not have to wait months to collect. Money comes in as services are used.

For example:

Say, you run a gut-healing program that costs $1,800 over three months. Instead of one big invoice, you send a $600 link at the start of each month. Patients feel less sticker shock. You get paid on time. Everyone wins.

The payment page matters as much as the process. If you send a link that opens to a clunky desktop site, patients will struggle. They will pinch and zoom. They will give up.

Curogram's payment page is built for phones first. When patients tap the link, they see a clean screen that fits their device.

If they have Apple Pay or Google Pay set up, they can pay with one tap. If not, they enter their card once and the system saves it for next time. Either way, the whole thing takes less than 30 seconds.

This ease is part of the boutique practice patient experience. When billing feels as smooth as texting a friend, patients notice. They tell others. They come back.

Compare this to the old portal model. A patient gets an email with a login link. They cannot remember their password. They click "forgot password" and wait for a reset email.

They create a new password. They finally log in and hunt for the pay button. By then, five minutes have passed and they are annoyed.

That annoyance sticks. It colors how they feel about your practice. But when you make paying easy, you show that you respect their time. That feeling sticks too—in a much better way.

MD-HQ billing convenience is not just about getting paid faster. It is about honoring the care you provide with a finish that matches.

.png?width=2000&height=1125&name=How%20Frictionless%20Medical%20Billing%20for%20Cerbo%20Transforms%20Patient%20Payments-inline%20(1).png)

When you hear the word "frictionless," you might wonder if it means "less secure." After all, speed and safety often seem like trade-offs.

But with modern payment tools, the opposite is true. Secure SMS payment links are often safer than the old ways of taking cards.

Let us break down how this works and why it matters for your Cerbo practice:

Every business that handles card payments must follow PCI-DSS rules. PCI stands for Payment Card Industry. DSS stands for Data Security Standards. These rules exist to protect card data from theft.

There are four levels of PCI compliance. Level 1 is the highest. It applies to companies that process millions of transactions each year. Banks, major retailers, and payment processors all meet Level 1 standards.

Curogram's payment system uses Level 1 compliant processing. This means the same protections that guard your bank also guard your patient payments.

Card data travels through encrypted channels. It never sits on your office computer. It never passes through your local network.

Why does this matter for your practice? Because if card data is stolen from your system, you face big problems. Fines can reach tens of thousands of dollars. You could lose the right to accept cards at all. And the trust you built with patients can vanish overnight.

With frictionless medical billing for Cerbo, you off-load that risk. The payment happens on a secure, hosted page.

Your staff never sees the full card number. Your server never stores it. The whole process happens in a protected space outside your walls.

Think about how card payments work in many practices today. A patient calls to pay a balance. They read their card number out loud. A staff member types it in or writes it on a note. That note sits on a desk until someone enters it into a system.

This process has holes at every step. The phone call itself is not encrypted. Anyone nearby could hear the numbers.

The sticky note could get lost or thrown away where someone finds it. The manual entry could go into a system that is not fully secure.

Now, consider text-to-pay for doctors. Your staff sends a link. The patient taps it on their own phone. They enter their card into a secure form. The data goes straight to the payment processor. No one at your office ever touches it.

This removes the human error factor. No more misheard digits, lost notes, or staff members forgetting to shred papers. The patient handles their own data on their own encrypted device.

For HIPAA-minded practices, this matters even more. While card data is not technically PHI, the way you handle payments can still create compliance issues.

Mixing card numbers with patient names on sticky notes could expose you to risk. Secure SMS payment links keep everything separate and safe.

After a patient pays, what happens next? In the old model, they might get a paper receipt from your printer. Or they might get nothing at all until a statement arrives weeks later.

With Curogram, the patient gets a digital receipt the moment payment clears. This receipt lands right in their text thread. They do not have to dig through email spam folders. They do not have to log into a portal.

This instant receipt serves two purposes:

It gives the patient peace of mind. They know the payment went through. They have proof on their phone.

It helps with HSA and FSA accounts. Many patients in boutique and cash-pay practices use Health Savings Accounts or Flexible Spending Accounts. These accounts require proof of payment for tax purposes. A digital receipt makes record-keeping easy. The patient can save it, email it, or take a screenshot. No more calling your office to request a copy.

This small touch adds to the boutique practice patient experience. It shows that you thought about their needs beyond the visit itself.

Let us paint a picture of what can go wrong without secure systems:

A patient named Mark calls your office to pay for a follow-up lab. Your front desk staffer, Anna, answers while helping another patient check in. She grabs a pen and the nearest piece of paper—a Post-it note from her desk.

Mark reads his card number. Anna writes it down. She thanks him and hangs up. But now she is busy. Two more patients walk in. The phone rings again. She sets the Post-it aside and forgets about it.

Two hours later, a cleaning crew empties the trash. That Post-it ends up in a bag that goes to the dumpster. Maybe no one ever sees it. But maybe someone does.

This is not a rare event. Studies show that card fraud often starts with low-tech theft. A number on a napkin. A receipt left in a restaurant. Human error creates most security gaps.

Now, compare that to the secure link flow. Anna gets Mark's text. She replies with a payment link. Mark taps it, pays, and gets his receipt. The whole thing took 90 seconds. Anna never saw the card. No paper changed hands. No risk was created.

Here is the key insight: Friction often comes from manual steps. And manual steps are where errors happen. When you remove friction, you remove the chance for mistakes.

Frictionless medical billing for Cerbo does not mean skipping safety checks. It means automating them. The encryption happens in the background. The compliance rules are baked in. The patient just sees a simple, fast way to pay.

This is modern security. It works not by adding barriers but by removing weak points.

Every time your staff does not touch card data, you lower your risk. Every time a patient pays on their own device, you raise your safety standard.

For practices that pride themselves on trust and care, this matters. Your patients share sensitive health details with you. They should be able to trust that you handle their money with the same care.

When you upgrade to secure SMS payment links, you are not cutting corners. You are closing gaps.

The way people pay for things has changed. Think about your own life. When did you last write a check? When did you last count out exact cash for a purchase? For most of us, these moments are rare now.

Your patients live in the same world. They tap their phone to buy coffee. They use apps to split dinner with friends. They expect the same speed and ease when they pay for care.

MD-HQ billing convenience means meeting patients where they are. It means giving them the tools they already know how to use. It means not making them jump through hoops just to settle a balance.

Frictionless medical billing for Cerbo is not a luxury. It is what modern patients expect. When you deliver it, you stand out from practices stuck in the past. You show that you care about the full experience, not just the clinical side.

The upgrade does not require a full system overhaul. Curogram connects with your Cerbo EHR. Your staff can learn the basics in minutes. Patients start getting secure SMS payment links right away.

Want to see the real impact on your bottom line? Use our free ROI calculator to find out how much time and money your practice could save.

How Curogram Turns Billing Into a Seamless Part of Patient Care

For Cerbo practices that want to deliver a true concierge experience, Curogram acts as your billing layer. It sits on top of your existing MD-HQ system and handles the payment side with ease.

Patients receive payment requests by text. No portal logins. No emails lost in spam. Just a simple message with a secure link. They tap, pay, and get a receipt in seconds. The whole flow works on any phone without apps or downloads.

Your staff saves time on every transaction. No more phone calls to chase balances. No more manual card entry. No more sticky notes with numbers scribbled on them. Payment becomes a quick, clean task instead of a time drain.

Your cash flow improves because patients pay faster. When paying feels easy, people do not put it off. You get more same-day payments and fewer aging balances. This helps your practice run smoother and plan better.

Your brand stays polished from visit to checkout. The boutique practice patient experience depends on details. When billing matches the quality of care, patients notice. They feel respected. They come back. They tell friends.

Curogram also protects your practice with top-tier security. All payments run through PCI-DSS Level 1 compliant systems. Card data never touches your local servers. Your risk drops while your convenience rises.

Set-up is fast. Training takes about 10 minutes. Your team can start sending secure SMS payment links the same day.

For practices built on high-touch care and personal service, Curogram closes the loop. It turns billing from a weak point into a strength.

Your patients chose your practice for a reason. They wanted more than factory-style care. They wanted attention, expertise, and a personal touch. The billing process should honor that choice.

Frictionless medical billing for Cerbo makes this possible. It turns payment from a pain point into a smooth finish. Patients tap a link, pay in seconds, and get their receipt right away.

For your staff, the benefits add up fast. Less time on the phone chasing payments. Less risk from writing down card numbers. More focus on the tasks that matter most. Mobile patient payments free your team to do real work instead of busy work.

For your brand, the impact is clear. The boutique practice patient experience extends all the way to checkout. Every detail says you care about your patients' time. Every easy payment builds trust and loyalty.

Text-to-pay for doctors is not a trend. It is the new standard. Patients expect it because they use it everywhere else. When you deliver that same ease, you meet them where they are.

Curogram makes the switch simple. The platform works with your Cerbo EHR right out of the box. Your staff can learn the basics in minutes. Secure SMS payment links start going out the same day. The result is a billing workflow that matches the quality of your care.

Simplify your cash flow. Book a demo today to see how frictionless medical billing for Cerbo can lift your patient experience.

With Curogram, the SMS comes from your practice's own phone number. If you have used text-to-pay for doctors before, the patient already knows this number. It is the same one that sends appointment reminders and other updates. The message also includes your clinic's name and branding.

Phone calls can be overheard and card numbers written on notes can be lost. Secure links send patients to an encrypted page where they enter their own data. Your staff never sees or stores the full card number.

Patients get proof of payment sent right to their phone the moment they pay. They can save, forward, or screenshot the receipt. This makes it simple to track medical expenses and submit claims for tax benefits.

💡 Picture your billing specialist spending hours calling patients about overdue balances, only to reach voicemail. Text-to-Pay sends secure payment...

💡 Text-to-Pay in StreamlineMD lets imaging and vascular practices collect payments faster through secure text messages. Patients get a direct...

💡 When you collect patient co-pays upfront in CollaborateMD using Curogram, you reduce bad debt and speed up cash flow before care begins. ...