Text-to-Pay for Oracle Health Systems

💡 Text-to-pay for Oracle Health systems helps large healthcare networks collect patient payments faster and reduce billing workload. This approach...

15 min read

Aubreigh Lee Daculug

:

January 30, 2026

Every morning, practice owners and CFOs wake up to the same problem. Thousands of dollars sit frozen in accounts receivable, locked away from your practice's growth potential. This isn't just a minor inconvenience. It's a direct threat to your financial health.

The problem starts the moment you complete a patient visit. You've delivered excellent care. Your staff documented everything properly.

The billing team submitted claims and calculated patient responsibility. But then the waiting begins. Days turn into weeks. Weeks turn into months. Your money sits in limbo while your practice needs keep mounting.

Traditional billing methods create a cash flow crisis that most practices simply accept as normal. Paper statements get lost in the mail or buried under other household bills. Patient portals require passwords nobody remembers, creating a barrier that stops payment before it starts.

Phone calls from billing staff eat up productive hours, with many calls going to voicemail or requiring multiple attempts. Meanwhile, your ability to invest in equipment, hire talent, or expand services stays paralyzed.

The irony is painful. You're running a successful practice with full schedules and satisfied patients. Revenue keeps growing on paper. But your bank account tells a different story.

The gap between services rendered and cash collected creates a constant state of financial stress that affects every business decision you make.

The cost of this delay compounds daily in ways that damage your bottom line. After 60 days, medical debt becomes increasingly difficult to collect as patient memory fades and other priorities take over. Your overhead continues regardless of when payment arrives.

Staff spend valuable time chasing payments instead of supporting patient care or handling more productive tasks. This cycle drains profitability from even the busiest specialty practice revenue cycle.

Consider what this means for your practice valuation. When potential buyers or investors evaluate your business, they look at more than gross revenue.

They examine how efficiently you convert services into cash. High accounts receivable days signal operational weakness. Slow collections suggest you're leaving money on the table. These red flags can reduce your practice value by hundreds of thousands of dollars.

Smart practice owners are breaking free from this trap. They're discovering that mobile payment technology isn't just convenient. It's a powerful tool to improve collection rates and accelerate financial velocity.

The solution lies in meeting patients where they already are: on their phones. This shift represents more than a technology upgrade. It's a fundamental rethinking of how medical practices capture the value they create.

Paper billing creates a silent tax on your specialty practice profitability. Each unpaid invoice represents capital that can't work for your business. This stagnant money prevents you from seizing opportunities, upgrading technology, or weathering unexpected challenges.

While you wait for payments to arrive, your competitors with faster billing cycles are reinvesting their capital and pulling ahead.

The math is brutal. A $50 co-pay might require three paper statements at $3 each. Add two 15-minute phone calls from your billing specialist. Suddenly, your profit margin disappears. Multiply this across hundreds of patients, and you're losing thousands monthly to administrative waste.

But the visible costs are just the beginning. Consider the opportunity cost of delayed payment. That $50 sitting in accounts receivable for 60 days could have been earning interest, paying down debt, or funding marketing that brings in new patients. The true cost of paper billing extends far beyond postage and labor.

Time makes everything worse in a way that accelerates exponentially. After 30 days, collection probability drops significantly as the bill loses urgency in the patient's mind. After 60 days, you're fighting an uphill battle against forgotten visits and competing financial priorities.

After 90 days, many practices write off the debt entirely, accepting a total loss. This isn't just lost revenue. It's a failure of your billing system to reduce medical A/R effectively.

The psychology of delayed billing works against you. When patients receive a bill weeks after their visit, the service feels disconnected from the payment request.

They question charges they don't remember. They dispute services that seemed included in their copay. Every day of delay increases the likelihood of payment resistance.

Manual collection processes magnify these problems across multiple dimensions:

Each friction point slows down your cash conversion cycle and increases operational costs. These inefficiencies compound over time, creating a drag on profitability that many practices simply accept as normal.

But accepting inefficiency doesn't make it less damaging to your financial health.

The hidden costs extend into staff morale and retention. Billing staff didn't enter healthcare to chase payments. They wanted to help patients and support quality care.

When their days fill with uncomfortable collection calls, job satisfaction plummets. Turnover increases. Training costs rise. The cycle of inefficiency feeds on itself.

Slow billing doesn't just affect your current operations. It fundamentally limits your ability to grow and adapt to market changes. When capital sits frozen in receivables, you can't respond quickly to opportunities.

A chance to acquire a competing practice passes by. New technology that could improve patient outcomes remains out of reach. Strategic marketing initiatives get postponed indefinitely.

Banks and lenders notice these patterns too. When you seek financing for expansion, they examine your accounts receivable aging closely.

High A/R days signal risk. Slow collections suggest operational problems. This translates directly into higher interest rates or loan denials that prevent growth even when the demand exists.

Text messages cut through the noise like nothing else. With a 98% open rate, SMS ensures your billing message actually reaches patients. Compare that to paper mail, which often goes unopened, or email, which lands in spam folders.

This immediate visibility drives faster payment decisions. Patients see your message within minutes of sending, not days or weeks later.

The medium itself carries weight. Text messages feel urgent and personal in a way that printed statements never do. When a patient's phone buzzes with a payment notification, they respond.

The same message buried in a stack of mail gets ignored. This psychological difference translates directly into faster cash collection.

The genius lies in removing friction at every step of the payment journey. With text-to-pay, patients receive a secure payment link directly on their phone.

No logging into portals with passwords they created months ago and promptly forgot. No remembering where they filed the paper statement. No searching for your phone number to call with questions.

One tap launches the payment screen. This simplicity transforms procrastination into immediate action.

Consider the typical patient portal experience. First, they need to remember your practice name exactly as it appears in the system. Then they search for the login page.

They try their usual password. It fails. They try another password. It fails again. They click "forgot password" and wait for an email. That email lands in spam. Frustrated, they give up. Your payment never happens.

Mobile payment bypasses this entire nightmare. The link goes directly to a secure payment page with their balance already displayed. They enter payment information once and save it for future use.

The entire process takes less time than finding a stamp for a paper check. This ease of use directly addresses the reality that most payment delays stem from inconvenience rather than inability to pay.

Speed creates predictability in ways that transform financial planning. Over 30% of patients settle their balance within minutes of receiving a text.

This rapid response lets you forecast cash flow with confidence. You know exactly when money will hit your account, making financial planning actually reliable. No more guessing whether this month's receivables will cover next month's payroll.

Healthcare payment automation eliminates the waiting game that plagues traditional billing. Instead of wondering if your statement reached the patient, you receive delivery confirmation instantly.

Instead of hoping they'll mail a check, you see real-time payment notifications. Instead of waiting weeks for bank deposits, funds appear in your account within days. This visibility gives you control over your financial destiny.

The data benefits extend beyond simple tracking. You can identify patterns in payment behavior. Which patients pay immediately? Which ones need reminders? What time of day generates the most payment activity? These insights let you optimize your billing strategy continuously, improving results month after month.

This shift from delayed to immediate liquidity changes everything about how your practice manages money and plans growth. You can make strategic decisions based on actual cash position rather than projected receivables.

You can invest in opportunities when they arise instead of waiting for payments to trickle in. You can negotiate better terms with suppliers when you pay promptly with cash in hand.

Mobile payments improve patient satisfaction in ways that strengthen your practice's reputation. Patients appreciate the convenience and transparency.

They can pay on their schedule, whether that's immediately after their appointment or during their evening routine. They receive clear breakdowns of charges with no surprise fees. This positive experience encourages them to return and refer others.

The alternative creates frustration that damages relationships. Patients who receive multiple paper statements feel harassed. Those who struggle with portal logins feel incompetent.

People who face surprise collections notices feel betrayed. Every negative billing experience chips away at the trust you've built through quality care.

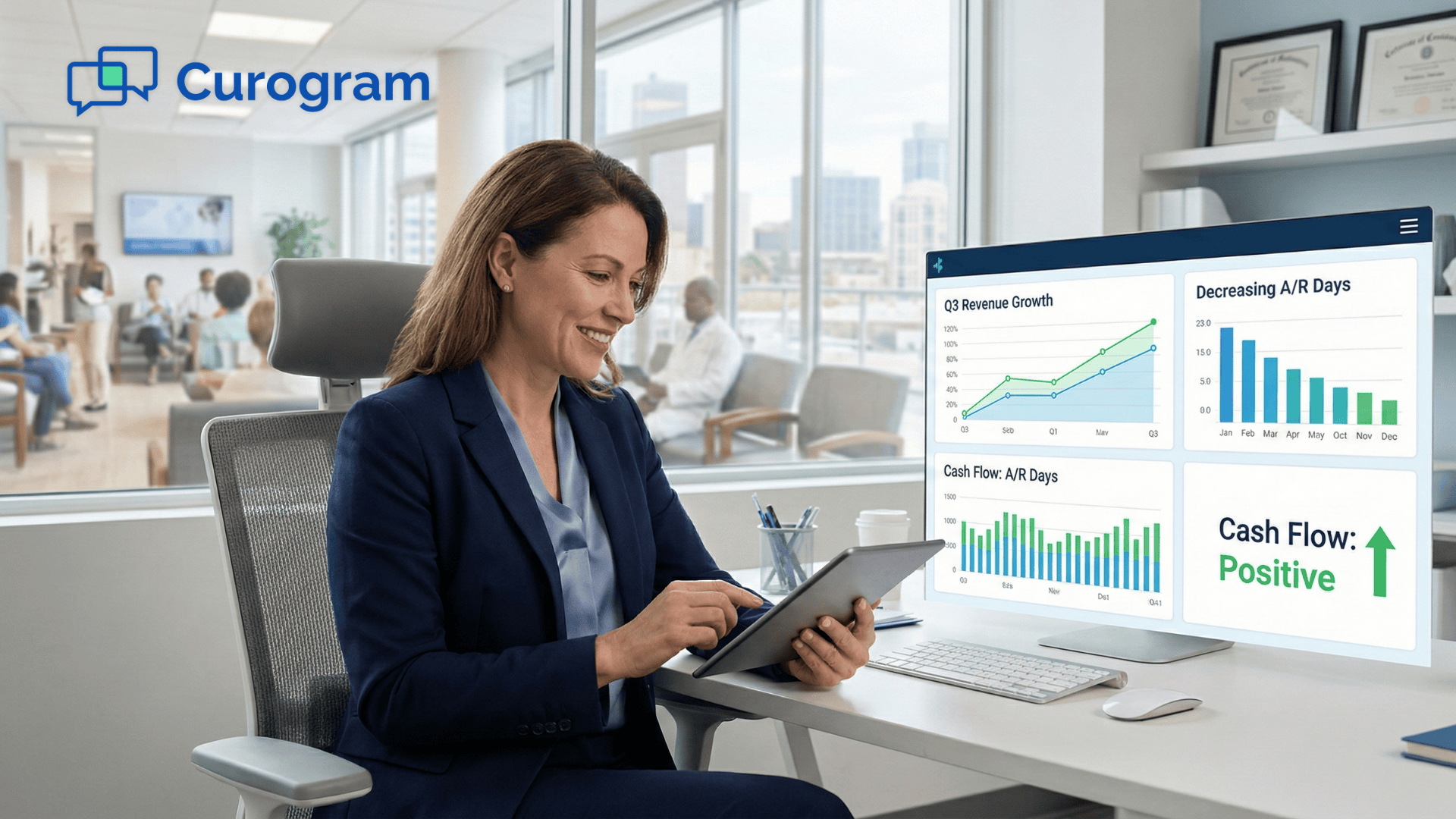

The numbers tell a powerful story. Practices using ModMed with mobile billing see their accounts receivable days drop by 65%. This isn't a small improvement. It's a fundamental transformation of how money moves through your business.

Capital that was frozen for months now flows freely. This acceleration has ripple effects throughout your entire operation.

Think about what this means in practical terms. If your practice currently carries 60 days in accounts receivable, you're essentially providing free financing to patients for two months.

That's two months of rent, salaries, supplies, and insurance premiums you're covering while waiting for payment. Reducing A/R days to 21 means you're financing patients for less than three weeks. The capital freed up can be substantial.

Payment volume jumps dramatically too. The 300% increase in successful collections reflects what happens when you meet patients on their terms.

Mobile devices are always nearby. Payment takes seconds. Impulse payments replace endless delays, directly boosting dermatology clinic profitability and orthopedic billing ROI.

These gains happen because mobile payments capture moments when patients are ready to act. Right after an appointment, while the visit is fresh in their mind and they're still thinking about their healthcare.

During lunch breaks when they're checking their phone and handling personal tasks. Late evening when they're reviewing their day and taking care of responsibilities. Traditional billing misses all these payment opportunities by creating delays and barriers.

The psychology of immediate payment works in your favor. When patients receive a text right after their visit, the service and value are top of mind.

They remember why they came in. They appreciate the care they received. This positive association makes payment feel natural rather than burdensome. Wait three weeks to send a bill, and that emotional connection disappears.

Let's break down the true cost of paper billing in detail:

Multiply by thousands of patients annually, and automation saves tens of thousands in pure profit. A practice sending 500 statements monthly wastes $18,000 per year on paper billing alone.

That's capital that could fund equipment upgrades, staff bonuses, or practice expansion. For larger practices sending 1,000 statements monthly, the waste doubles to $36,000 annually.

But even these numbers understate the true cost. Consider the staff time spent handling payment questions, researching discrepancies, and updating patient accounts manually.

Add the cost of payment processing delays that extend your cash cycle. Factor in the write-offs from uncollected balances that age beyond recovery. The total cost of traditional billing often reaches $5 or more per transaction when you account for all the hidden expenses.

Here's what the transformation looks like for a typical specialty practice:

Traditional Paper Billing vs. Mobile Payment

| Metric | Paper Billing | Mobile Payment | Improvement |

|---|---|---|---|

| Average A/R Days | 60 days | 21 days | 65% reduction |

| Payment Success Rate | 45% | 135% | 300% increase |

| Cost Per Statement | $3.00 | $0.15 | $2.85 savings |

| Monthly Statements | 500 | 500 | — |

| Monthly Billing Cost | $1,500 | $75 | $1,425 saved |

| Annual Billing Cost | $18,000 | $900 | $17,100 saved |

These aren't theoretical numbers. They represent the actual financial shift that practices experience when they move from paper-first to mobile-first billing. The improvement shows up immediately in your bank account and financial reports.

These savings compound over time in ways that transform your entire operation. Lower overhead means better margins on every patient encounter. Faster collections mean more working capital for strategic investments.

Higher staff productivity means better patient service and reduced turnover. The financial benefits ripple through every aspect of your specialty practice revenue cycle, improving both liquidity and valuation.

Consider the multiplier effect of improved cash flow. When you collect payments 40 days faster, that's capital you can reinvest immediately. Invest in marketing that brings in new patients.

Those patients generate revenue that you collect quickly through the same mobile system. That revenue funds additional growth initiatives. The cycle accelerates your practice's financial performance in ways that compound year after year.

The valuation impact deserves special attention. When private equity firms or potential buyers evaluate your practice, they calculate value based partly on how efficiently you convert revenue into cash.

A practice with 21-day A/R looks far more attractive than one with 60-day A/R. This difference can translate into hundreds of thousands of dollars in additional practice value when you're ready to sell or seek investment.

Moving to mobile billing requires more than just flipping a switch. Strategic implementation determines whether you capture the full ROI potential or leave money on the table. The practices that see the most dramatic results follow proven strategies that optimize every aspect of the transition.

When you send payment requests matters as much as how you send them. The timing strategy directly impacts your collection rate and speed. Understanding patient behavior patterns lets you maximize the psychological advantage of mobile payments.

Send the first payment request immediately after checkout while the patient is still at your practice or driving home. This captures the moment when service value is highest in their mind.

Follow up 24 hours later for unpaid balances, catching patients during their evening routine when they handle personal tasks. Send a third reminder at 7 days for maximum persistence without harassment.

Weekend mornings generate surprisingly high payment rates. Patients have time to review finances and take care of errands without work pressure. Thursday evenings also perform well as people prepare for the weekend and clear pending tasks. Avoid Monday mornings when inboxes overflow and stress runs high.

The words you use in payment requests significantly impact response rates. Clear, friendly messages that emphasize convenience outperform formal billing language. Your tone should match how patients already communicate via text with businesses they trust.

Key elements that drive higher payment rates include:

Avoid billing jargon that confuses patients. Skip threatening language about collections. Don't include excessive detail that requires scrolling. The message should take 5 seconds to read and understand. Complexity kills conversion in mobile communications.

Your front desk team plays a crucial role in mobile payment success. They set patient expectations during checkout and handle questions about the new process. Proper training ensures they promote mobile payment confidently rather than apologizing for it.

Staff should explain the process proactively at checkout. A simple script works best: "You'll receive a secure text with a payment link within the next few minutes.

Just tap the link to pay your balance. It's faster than logging into the portal and you don't need to remember any passwords." This sets clear expectations and emphasizes convenience.

Train staff to handle common objections smoothly. When patients say they prefer paper statements, staff can respond: "Absolutely, we can send paper too. But most patients find the text link much faster. Why don't you try it once and see if you like it?" This acknowledges preference while encouraging adoption.

Not all patients respond the same way to mobile billing. Segmentation lets you customize your approach for maximum results. Age, balance amount, and payment history all influence the optimal strategy.

Younger patients typically need minimal encouragement. They expect mobile payment options and adopt them immediately. Focus your staff attention on older demographics who may need more explanation and reassurance. Highlight security and simplicity when introducing the option to seniors.

Large balance amounts require different handling than small copays. For balances over $500, consider offering payment plan options proactively in your first text.

This removes the mental barrier that delays payment when patients see a number they can't handle immediately. Breaking a $1,200 balance into four $300 payments dramatically improves collection rates.

Payment history predicts future behavior. Patients who consistently pay quickly need minimal follow-up. Those with patterns of delayed payment benefit from more frequent, gentle reminders. Your system should automatically adjust reminder frequency based on individual payment behavior.

Continuous improvement separates good results from great ones. Track key metrics weekly and adjust your approach based on data. Small tweaks to timing, messaging, or process can yield substantial improvements in collection rates.

Monitor these critical metrics:

Run A/B tests on message content and timing. Send half your payment requests at 5 PM and half at 8 PM to identify the optimal time for your patient population. Test different message variations to find language that resonates. Data-driven optimization compounds your results over time.

The practices that achieve the highest ROI treat mobile billing as an evolving strategy rather than a static system. They review performance monthly, celebrate improvements, and continuously refine their approach. This commitment to optimization ensures you capture every dollar of potential value.

Absolutely. The cost of carrying debt for 60 days far exceeds standard processing fees. Think about the labor hours spent chasing payments. Consider the opportunity cost of frozen capital. Factor in the high probability of never collecting older balances.

A small transaction fee pales in comparison to these hidden costs. Quick payment means you can reinvest that money immediately. It means lower staffing costs for collections. Most importantly, it means you actually get paid instead of writing off bad debt.

Let's examine the math directly. A typical credit card processing fee runs between 2% and 3%. On a $100 patient balance, that's $2 to $3. Compare that to sending three paper statements at $3 each, plus staff time making follow-up calls.

The traditional approach costs $9 in direct expenses alone, not counting the value of delayed payment. The mobile payment approach costs $3 in processing fees and gets you paid 40 days faster. The choice becomes obvious when you run the numbers honestly.

Yes, especially now. As patient responsibility increases through high-deductible health plans, payment convenience becomes critical. Patients face larger bills than ever before. Complex payment processes cause them to delay or avoid payment entirely.

Simple mobile payments remove this barrier. Patients can pay immediately after service while they're still thinking about their visit. They can set up payment plans through the same interface. This ease of use is often the deciding factor between prompt payment and eventual collections.

The trend toward high-deductible plans shows no signs of reversing. More patients are responsible for the first $2,000, $5,000, or even $10,000 of their healthcare costs each year.

These aren't small co-pays they can handle without thinking. They're significant expenses that require planning and effort to pay. Making that payment process as smooth as possible dramatically improves your collection rate.

Consider also that patients with high-deductible plans are often more financially savvy. They chose these plans to save on premiums. They track their healthcare spending carefully. They appreciate transparent, convenient payment options that give them control.

Mobile payments align perfectly with how these patients want to manage their healthcare finances.

Yes, the financial impact shows up clearly in your standard reports. Monitor your Days Sales Outstanding to see how quickly you're converting services into cash. Review your collection aging reports to watch old balances disappear. Track your collection rate percentage as it climbs.

Most practices see measurable changes within two billing cycles. The shift is dramatic enough that you won't need complex analysis. Your cash position improves. Your A/R aging shrinks. Your staff spends less time on collections. The results speak for themselves in your bottom line.

ModMed's reporting tools make this tracking straightforward. You can compare your current A/R days against historical averages. You can segment collection rates by payment method to see the mobile advantage clearly. You can calculate the exact dollar impact of reduced billing costs.

These reports give you the data you need to justify the investment and demonstrate the value to stakeholders.

Some patients will always prefer paper statements, particularly older demographics. The beauty of a mobile-first approach is that it doesn't eliminate traditional options. You can still send paper statements to patients who request them while defaulting to mobile for everyone else.

In practice, most patients who initially express preference for paper billing quickly adapt once they experience mobile payment. The convenience wins them over.

They discover that paying by text is faster and easier than writing checks or calling with credit card numbers. Resistance typically comes from unfamiliarity rather than genuine preference.

The key is offering choice while making the better option the default. Send the first payment request via text. Include clear instructions. Make the process obviously simple.

Most patients will use it. For the small percentage who don't, follow up with traditional methods. You still capture the efficiency gains for the majority while accommodating everyone's needs.

Every day your practice operates with slow billing is a day you're leaving money on the table. The solution isn't working harder or hiring more collections staff. It's working smarter by leveraging technology that patients already use every day. This shift from labor-intensive to technology-enabled billing represents the future of healthcare finance.

The transformation goes beyond simple efficiency gains. Mobile payment technology delivers results that traditional billing simply cannot match. The 65% reduction in accounts receivable days means your capital works for you instead of sitting idle.

The 300% increase in payment success means you improve collection rates while reducing collection costs. This combination drives real profitability that shows up in every financial metric that matters.

Consider what freed capital enables for your practice. You can upgrade to the latest diagnostic equipment that improves patient outcomes and attracts referrals.

You can hire additional providers to meet growing demand without waiting months for cash flow to support the expansion. You can invest in marketing initiatives that have proven ROI but require upfront investment. You can build cash reserves that protect your practice during unexpected challenges.

The competitive advantage extends beyond your own operations. Patients increasingly expect modern, convenient payment options. They're accustomed to one-click purchasing in every other aspect of their lives.

Practices that force them into outdated billing processes create friction that damages satisfaction and loyalty. Meeting patient expectations for payment convenience is becoming as important as meeting clinical quality standards.

The path forward is clear. Specialty practices need financial velocity to thrive in today's healthcare environment. Whether you run a dermatology clinic, orthopedic practice, or plastic surgery center, your billing system should accelerate cash flow, not strangle it.

Healthcare payment automation removes the barriers between services rendered and revenue received. This acceleration creates possibilities that simply don't exist when capital sits frozen for months.

The timing for this transformation has never been better. Patient responsibility continues to increase as healthcare costs shift from insurers to individuals. This trend makes payment convenience more critical than ever.

Practices that adapt now will capture market share from competitors still struggling with paper-based systems. The financial benefits compound with every month of faster collections and lower overhead.

Implementation doesn't require disrupting your entire operation. ModMed integration means mobile payments work seamlessly with your existing workflows.

Your staff doesn't need to learn complex new systems. Your patients don't need to change how they interact with your practice. The technology works in the background, quietly transforming your financial performance while everyone focuses on delivering great care.

The ROI timeline is remarkably fast. Many practices see measurable improvement within the first billing cycle. By the second month, the financial impact becomes undeniable.

Within six months, the cumulative benefits often exceed the annual cost of traditional billing systems. This isn't a long-term investment that pays off eventually. It's an immediate financial improvement that compounds over time.

Schedule a 10-minute demo today to calculate your practice's potential accounts receivable reduction. See exactly how Curogram's ModMed integration transforms your billing into a high-speed revenue engine.

💡 Text-to-pay for Oracle Health systems helps large healthcare networks collect patient payments faster and reduce billing workload. This approach...

💡 Cerbo EMR ROI for patient payments jumps when practices switch from portal billing to SMS-based text-to-pay links. Patients pay in seconds...

💡 Patient payments for Opus EHR are faster and easier with Curogram's text-to-pay platform. Billing teams send secure payment links by text to...