How SMS Mobile Payments Work: A Guide to Accepting Payments by Text

In our hyper-connected, mobile-first society, the standards for convenience are constantly being redefined. Businesses are in a continuous race to...

11 min read

Alvin Amoroso : July 17, 2025

In a world where smartphones are extensions of our hands, the way businesses interact and transact with customers is constantly evolving. The most successful companies are those that meet customers where they are, and today, that’s on their phones. This brings us to a simple yet revolutionary payment method gaining massive traction. So, what is text to pay?

Text to pay is a payment solution that allows businesses to send invoices, payment requests, and reminders to customers via SMS text message. Customers can then click a secure link within the message to complete their payment instantly from their mobile device, using a credit card, debit card, or digital wallet. This method bypasses the delays of email, the hassle of mail, and the friction of logging into a separate portal, making it one of the most direct and convenient ways to collect payments in the modern economy. For any business wondering how to streamline collections and improve cash flow, understanding what is pay by text is no longer optional—it's essential.

This comprehensive guide will walk you through everything you need to know. We'll explore exactly how it works, the profound benefits for your business, its security features, and how you can implement a pay by text system to revolutionize your payment process.

Understanding what is text to pay on the surface is simple, but seeing the mechanics reveals its efficiency. The process is designed to be seamless for both the business and the customer, minimizing steps and maximizing completion rates.

The entire pay by text workflow is built on a foundation of speed and security. From the moment a payment is due to the second it's confirmed, the system automates what was once a manual and time-consuming process. Let's break down the typical journey of a text-to-pay transaction.

The process begins when a payment is required. This trigger can be automated or manual. For instance, a trigger could be a scheduled invoice for a recurring service, a bill generated after a healthcare appointment, a payment due for a home service repair, or even a reminder for an abandoned online shopping cart. Your billing software or CRM identifies that a payment is needed and initiates the pay by text sequence.

Once triggered, the system automatically sends an SMS message to the customer's mobile number on file. This message is not just a simple reminder; it contains a unique, secure link. The message is often customizable but typically includes key information like the business name, the amount due, and a clear call to action. For example: "Hi [Customer Name], your payment of $75.99 to ABC Plumbing is due. Please pay securely here: [unique secure link]." This directness is a core component of what makes pay by text so effective.

The customer receives the text and simply taps the link. They are immediately taken to a secure, mobile-optimized payment page. This page is often branded with the business's logo to build trust. Here, the customer can view their invoice details and enter their payment information (credit card, debit card, ACH, or digital wallets like Apple Pay or Google Pay). For returning customers, this process can be even faster if their information is securely tokenized from a previous transaction, allowing for one-tap payments.

After the payment is successfully submitted, two things happen instantly. First, the customer receives an on-screen confirmation and is usually sent a confirmation text message or email with a receipt for their records. Second, the business's payment system is updated in real-time. The invoice is marked as paid, the accounting software is reconciled, and the funds are processed for deposit. This instant feedback loop closes the collection cycle immediately, drastically improving cash flow management.

The magic of this process relies on sophisticated technology working in the background. When a customer enters their card details, the information is not stored on the business's servers. Instead, it's handled by a secure payment gateway that communicates with the credit card networks and banks. Furthermore, a technology called tokenization is used. Tokenization replaces sensitive card data with a unique, non-sensitive string of characters (a "token"). This token can be safely stored to facilitate future one-click payments without ever exposing the actual card number, making the entire pay by text system incredibly secure and PCI compliant.

While it sounds like a simple phrase, understanding what is pay by text involves grasping its position in the broader landscape of digital payments. At its heart, pay by text is about leveraging the most ubiquitous and immediate communication channel available today—SMS—to facilitate financial transactions.

Unlike other methods that require customers to download an app, remember a password for a web portal, or find a paper bill, pay by text meets them in a space they check dozens of times a day: their text message inbox. It's a "push" method, meaning you proactively send the payment request to the customer, rather than "pulling" them towards a payment channel they have to seek out themselves.

This subtle difference is monumental. It removes virtually all friction from the payment process. The cognitive load on the customer is minimized. They don't have to think, "I need to go pay that bill." Instead, the bill comes directly to them with a simple, one-click path to completion. This fundamental shift in the payment dynamic is the answer to both what is text to pay and why it has become such a powerful tool for modern businesses. It transforms payments from a chore for the customer into a simple, two-second interaction.

Adopting a pay by text system isn't just about adding another payment option; it's about fundamentally upgrading your entire collections process. The benefits extend far beyond convenience, impacting your cash flow, operational efficiency, and customer relationships.

This is the most obvious benefit. In an age of on-demand everything, customers expect simplicity. Making a payment by tapping a link in a text message is the pinnacle of convenience. It can be done from anywhere, at any time, without needing to be near a computer or a checkbook. This positive, frictionless experience enhances customer satisfaction and loyalty.

Because text messages have an open rate of up to 98% (compared to around 20% for email), your payment requests are seen almost immediately. This immediacy, combined with the ease of payment, means you get paid faster. Businesses that implement pay by text often see a significant reduction in their days sales outstanding (DSO). Instead of waiting 30, 60, or 90 days for checks to be mailed and processed, payments can be collected within minutes of sending the request.

Late payments are often a result of forgetfulness or inconvenience, not an unwillingness to pay. Pay by text tackles both issues head-on. Automated reminders can be sent before a due date, and the payment link makes it effortless for customers to settle their bills the moment they are reminded. This proactive approach drastically cuts down on the number of delinquent accounts, saving your team countless hours in collection calls.

A pay by text system is also a powerful two-way communication channel. You can send appointment reminders, service updates, and confirmations through the same channel you use for payments. This consolidates communication and creates a more cohesive customer experience. Some platforms even allow for two-way conversational texting, enabling customers to ask questions directly about their bill.

The statistics speak for themselves. Not only do SMS messages have a 98% open rate, but around 45% of them receive a response. When the "response" is clicking a payment link, the results are powerful. You are leveraging a channel that people are conditioned to view and interact with instantly, giving your payment requests priority over an email that might sit unread for days.

Consider the costs of traditional invoicing: paper, envelopes, postage, printer ink, and the labor hours required to print, stuff, and mail everything. These costs add up quickly. A pay by text system automates the entire process for a fraction of the cost, eliminating material expenses and freeing up your administrative staff to focus on more value-added tasks.

Modern pay by text solutions are built with security as a top priority. As discussed, they use technologies like tokenization and operate through PCI-compliant payment gateways. This means you can offer your customers a highly convenient payment method without taking on the risk and liability of handling sensitive credit card data yourself.

Imagine your billing system automatically sending payment requests, tracking which have been paid, and sending reminders for those that haven't—all without human intervention. This is the reality of a well-implemented pay by text platform. It eliminates tedious manual tasks, reduces the chance of human error, and allows your business to scale its operations without proportionally increasing administrative headcount.

A common and valid question from both businesses and customers is about the security of this payment method. The short answer is: yes, when implemented correctly, pay by text is exceptionally secure. Reputable providers build their platforms on multiple layers of security to protect sensitive information.

Understanding these layers is key to trusting the process and communicating its safety to your customers.

When you combine these technologies, the pay by text method is often more secure than more traditional methods like reading a credit card number over the phone or mailing a check, both of which are susceptible to human error and interception.

While almost any business that collects payments can benefit from a pay by text system, certain industries see a particularly dramatic return on investment due to the nature of their customer interactions and billing cycles.

Implementing a pay by text solution is more straightforward than you might think. Here’s a step-by-step guide to getting started.

When evaluating different pay by text platforms, it's important to compare them on more than just price. Here are the key features that differentiate a good provider from a great one.

The world of what is text to pay is not static. As technology evolves, so will the capabilities of these platforms. Here are a few trends to watch:

By embracing pay by text now, you are not just solving today's payment challenges; you are positioning your business for the future of commerce.

"Txt to Pay" and "txt2pay" are common shorthand spellings for "Text to Pay." They all refer to the exact same process: a method where businesses send customers a payment request via an SMS text message, which contains a secure link for the customer to complete the payment on their mobile device. It’s a fast, secure, and convenient way to handle transactions.

Yes, Text to Pay is a very safe method to use, provided it is managed by a reputable provider. Secure Text to Pay systems do not send sensitive information like credit card numbers via text. Instead, they use multiple layers of security, including:

We've thoroughly explored the question, what is text to pay? It's far more than just another way to get paid. It is a strategic tool that addresses the core demands of today's consumers: speed, convenience, and security. By integrating a pay by text solution, you are not only improving your cash flow and reducing administrative overhead, but you are also delivering a superior customer experience that builds loyalty and trust.

From home services to healthcare, and from non-profits to retail, the applications are vast and the benefits are clear. The technology is secure, the implementation is straightforward, and the impact on your bottom line can be immediate and substantial. In 2025, waiting for checks to arrive in the mail is a relic of the past. The future of payments is already in your customers' pockets. It's time to meet them there.

In our hyper-connected, mobile-first society, the standards for convenience are constantly being redefined. Businesses are in a continuous race to...

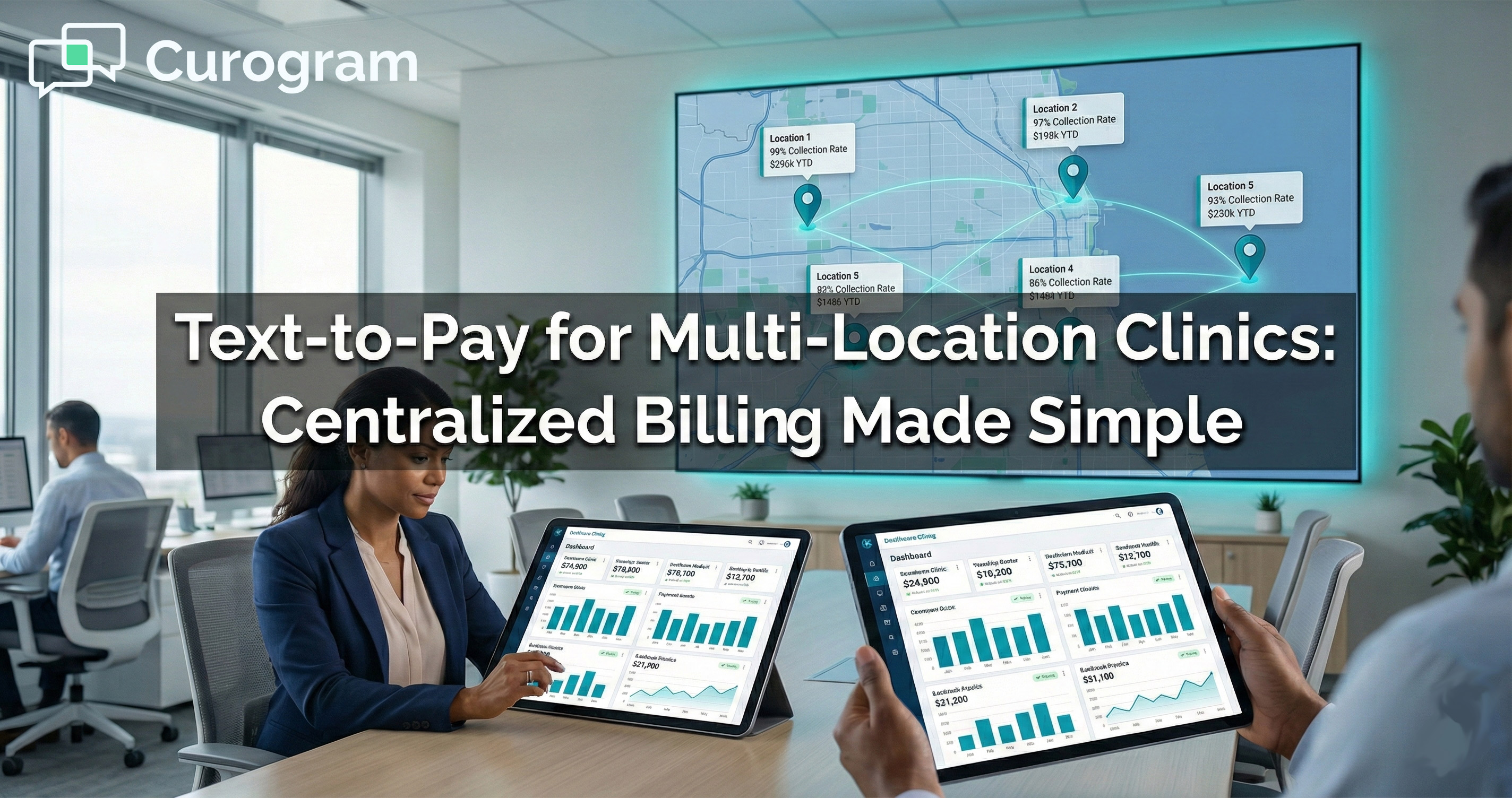

💡 Multi-location healthcare networks face a common challenge: managing payments across different sites with separate systems. This creates billing...

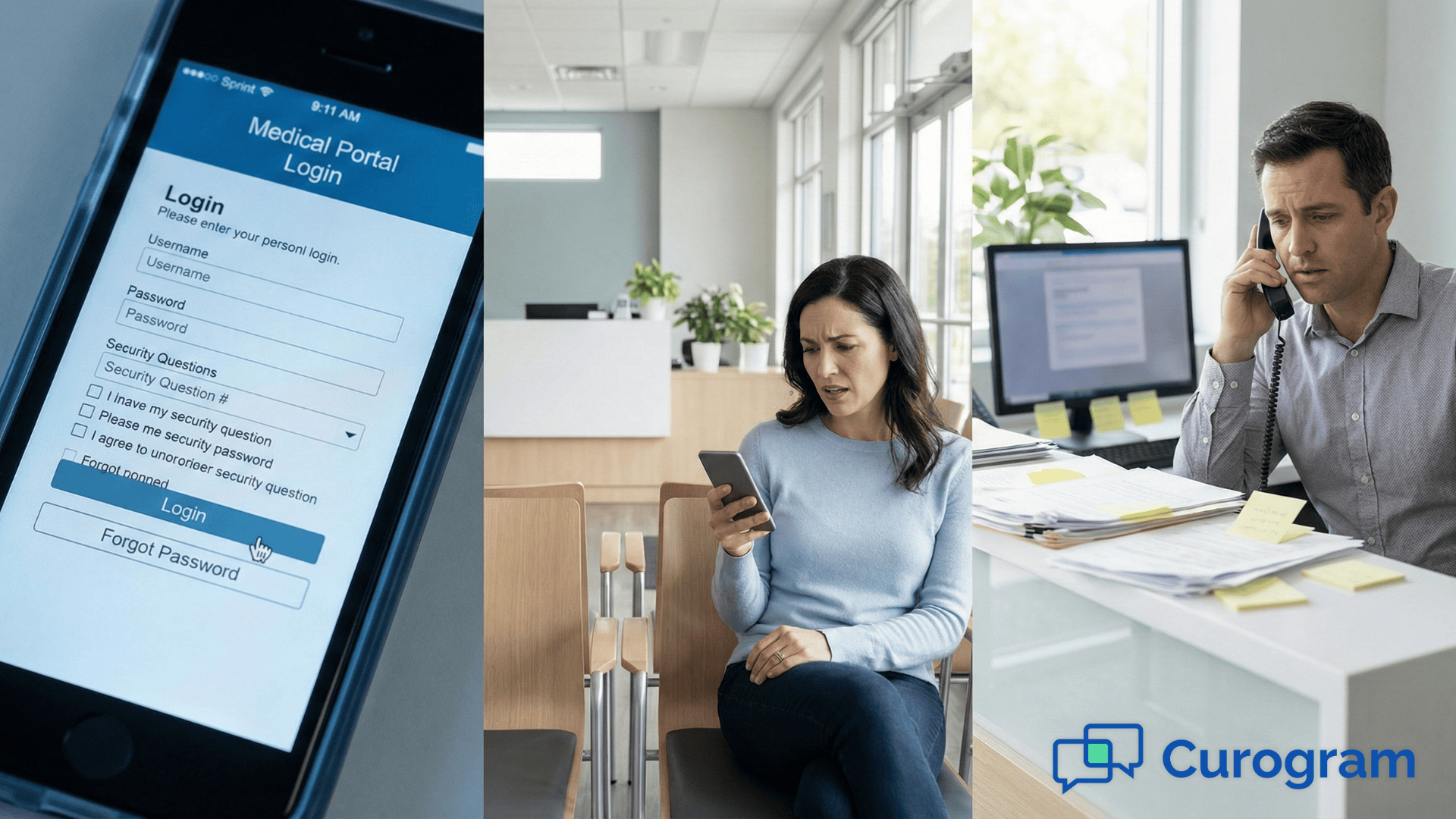

💡 Patient portals promised to revolutionize healthcare communication and billing, but most clinics see adoption rates below 25%. Too many login...