The Ultimate Guide to Contactless Patient Check-in and Contactless Hospital Check-in

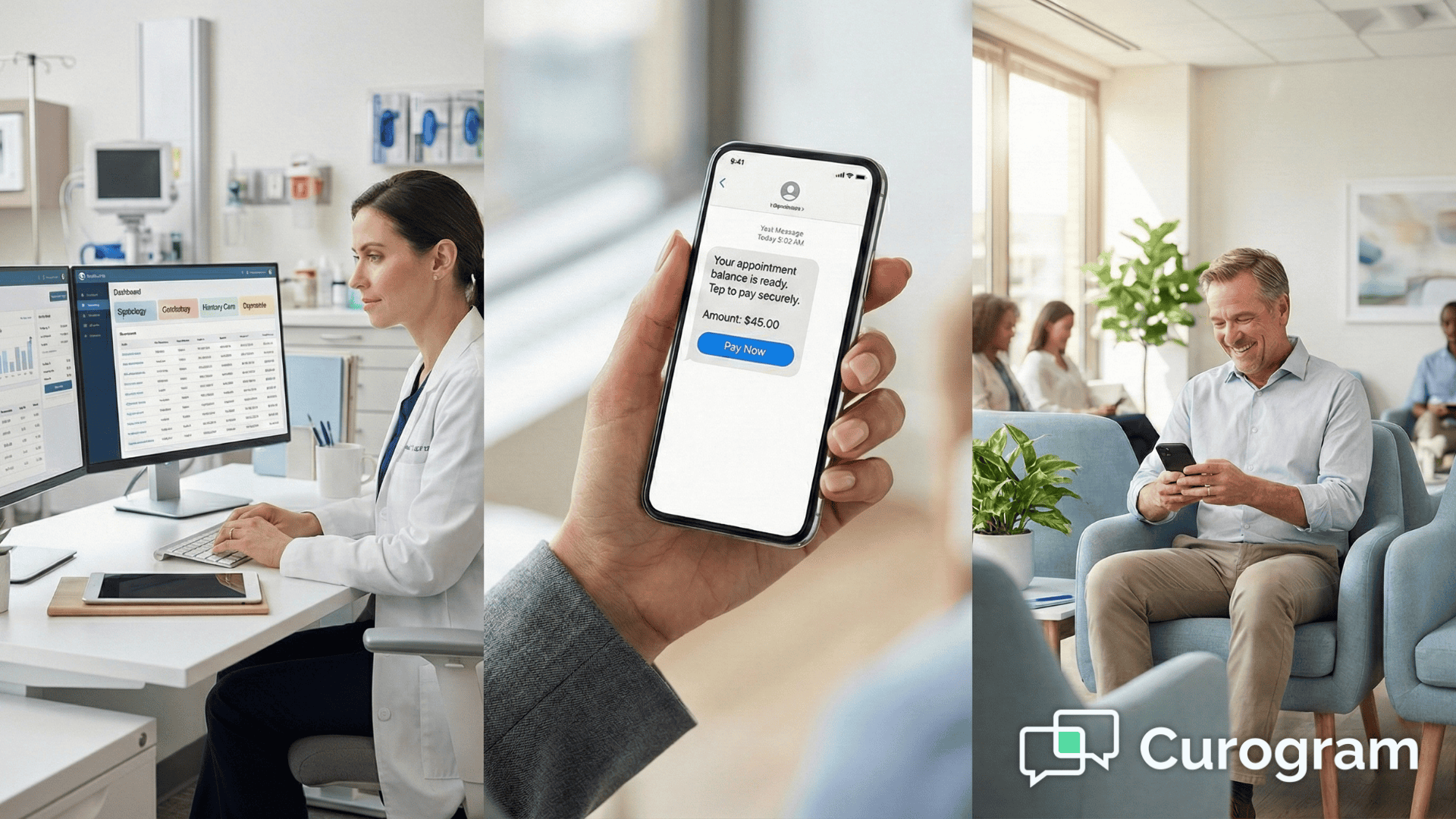

A contactless patient check-in system allows patients to complete registration, forms, and payments from their own device before arriving,...

19 min read

Alvin Amoroso : Updated on July 14, 2025

In the rapidly evolving landscape of healthcare, few areas are undergoing as profound a transformation as the financial ecosystem. The days of opaque billing, cumbersome paper statements, and confusing payment processes are numbered. In their place, a new era of clarity, efficiency, and patient empowerment is dawning, driven by one critical catalyst: healthcare payment technology.

This isn't just about digitizing old processes; it's a fundamental reimagining of how patients, providers, and payers interact. From the moment an appointment is scheduled to the final payment reconciliation, technology is smoothing friction points, enhancing security, and introducing a level of convenience once thought impossible in this sector. For healthcare organizations, embracing this evolution isn't just an option—it's a critical strategy for financial stability, operational excellence, and competitive differentiation.

This ultimate guide will serve as your comprehensive roadmap. We will delve deep into the core components of modern payment systems, explore the groundbreaking trends shaping the future, and provide a practical framework for implementing this transformative technology in a healthcare payment system. Whether you're a provider looking to optimize your revenue cycle, a patient seeking clarity, or a stakeholder mapping the future, this is your starting point for understanding the revolution in healthcare payments.

To fully appreciate the current revolution, it's essential to understand where we came from. The history of healthcare payments is a story of manual processes, information silos, and significant administrative burden.

The Era of Paper and Manual Processing (Pre-2000s)

For decades, the healthcare revenue cycle was almost entirely paper-based. The journey began with a patient's chart on a clipboard and ended, often months later, with a mailed paper check.

The Dawn of Digital: Electronic Data Interchange (EDI) and Early Systems (2000s-2010s)

The advent of the internet and digital standards began to chip away at the paper mountain. The Health Insurance Portability and Accountability Act (HIPAA) in 1996 standardized transaction formats, paving the way for Electronic Data Interchange (EDI).

The Modern Revolution: Real-Time, Integrated, and Patient-Centric (2010s-Present)

The confluence of cloud computing, mobile technology, API (Application Programming Interface) proliferation, and rising consumer expectations has triggered the current, most transformative phase. Today's healthcare payment technology is defined by its integration, intelligence, and focus on the user experience.

This journey from manual drudgery to intelligent automation highlights a clear trajectory: towards a more connected, transparent, and efficient financial ecosystem. The focus has shifted from provider-centric processes to a patient-centric experience, a theme that underpins the entire future of healthcare payment technology.

In today's challenging healthcare environment—marked by rising operational costs, shrinking margins, and increasing patient financial responsibility—an outdated payment system is not just an inconvenience; it's a significant liability. Adopting modern healthcare payment technology has become a cornerstone of financial health and patient satisfaction. The benefits ripple across every stakeholder in the ecosystem.

For hospitals, clinics, and private practices, the advantages of modern payment technology are direct and measurable, impacting everything from daily cash flow to long-term strategic planning.

The patient's financial journey has historically been the most broken part of their healthcare experience. Modern technology in a healthcare payment system fixes this by mirroring the seamless experiences they have in other industries.

Insurance companies (payers) also reap significant benefits from the modernization of the payment infrastructure, leading to more efficient partnerships with providers.

In essence, modern healthcare payment technology creates a virtuous cycle. When providers are more efficient, their costs go down. When patients have a clear and convenient experience, they are more likely to pay their bills promptly and report higher satisfaction. And when payers receive clean data, the entire system operates with less friction. This makes the adoption of such technology an imperative for survival and success in the 21st-century healthcare landscape.

A modern healthcare payment technology platform is not a single piece of software but an interconnected ecosystem of tools designed to work in harmony. Understanding these core components is crucial to appreciating their collective power to transform the revenue cycle. They form the engine that drives efficiency, security, and convenience.

These are the elements that patients interact with directly. Their quality and ease of use are paramount to a positive financial experience.

This is the behind-the-scenes engine that ensures payments are processed quickly, accurately, and securely.

This layer connects all the components and infuses the system with intelligence, ensuring seamless workflows and data-driven insights.

Together, these components create a cohesive, intelligent, and secure platform. They replace fragmented, manual processes with an automated, integrated workflow that benefits everyone involved, making the adoption of this sophisticated healthcare payment technology a strategic imperative.

The evolution of healthcare payment technology is accelerating. Driven by technological innovation and a seismic shift in patient expectations, the coming years will bring even more profound changes. Staying ahead of these trends is crucial for any healthcare organization looking to build a resilient and patient-centric financial future.

The one-size-fits-all approach to billing is dead. The future is about tailoring the financial experience to the individual patient's needs and preferences, a trend powered by data and AI.

The pandemic normalized contactless interactions, and this expectation has now been fully integrated into the healthcare setting. The goal is to make the payment process invisible and seamless.

Driven by both regulation (like the No Surprises Act) and consumer demand, radical price transparency is becoming a non-negotiable feature of the technology in healthcare payment systems.

While still in its early stages of adoption in healthcare payments, blockchain technology holds immense promise for solving some of the industry's most persistent problems.

Robotic Process Automation (RPA) uses software "bots" to perform repetitive, rules-based digital tasks that were previously handled by humans. Its integration into healthcare payment technology will unlock new levels of efficiency.

These trends paint a clear picture of the future: a healthcare financial experience that is personalized, seamless, transparent, and highly automated. The organizations that embrace this vision and invest in the right healthcare payment technology will be the ones that thrive in the years to come.

Adopting a new healthcare payment technology platform is a significant undertaking, but with a structured approach, it can be a smooth and highly rewarding process. A successful implementation goes beyond just installing software; it involves strategic planning, stakeholder buy-in, and a commitment to change management. This step-by-step guide provides a practical framework for success.

Before you can build your future, you must thoroughly understand your present.

You cannot manage what you do not measure. Define what success will look like in specific, quantifiable terms.

Choosing the right technology partner is the most critical decision in this process. Do not rush it.

This is the technical heart of the implementation process.

Technology is only as good as the people who use it. A change management plan is essential.

The go-live date is not the finish line; it's the starting line for continuous improvement.

By following this structured, methodical approach, a healthcare organization can navigate the complexities of implementation and unlock the full, transformative potential of modern payment technology.

While the benefits of modernizing your payment systems are clear, the path to adoption is not without its obstacles. Proactively identifying and planning for these common challenges is key to a successful implementation and long-term success. A thoughtful strategy can turn potential roadblocks into manageable tasks.

This is the most critical and non-negotiable challenge. The healthcare industry is a top target for cyberattacks, and a data breach involving protected health information (PHI) or payment card data can be catastrophic, leading to severe financial penalties, legal action, and irreparable damage to patient trust.

Strategic Solutions:

A new healthcare payment technology platform is a significant investment. Securing the budget and justifying the expense to leadership requires a clear, data-driven business case.

Strategic Solutions:

In many healthcare organizations, a new payment platform must coexist with a variety of other systems, some of which may be outdated. A lack of seamless communication—or interoperability—between these systems can cripple the new technology's effectiveness.

Strategic Solutions:

Humans are creatures of habit. Both internal staff and patients may be accustomed to the old way of doing things, and any change can be met with skepticism or resistance.

Strategic Solutions:

By anticipating these challenges and embedding solutions into your implementation plan, you can mitigate risks and ensure that your investment in new healthcare payment technology delivers on its promise to transform your organization.

In the United States, the sources of healthcare payment are broadly divided into two main categories: private and public. The most common single source of payment is private health insurance, which is typically provided by employers or purchased directly by individuals. This is followed closely by the major public programs: Medicare (primarily for individuals aged 65 or older) and Medicaid (for individuals and families with low incomes). The final piece is out-of-pocket payments, which is the share paid directly by the patient, including deductibles, co-pays, and co-insurance. The trend in recent years has been a significant increase in the out-of-pocket portion, which is a primary driver for the adoption of modern healthcare payment technology to make these payments easier for patients to manage.

The most widely used and arguably most impactful technology in healthcare today is the Electronic Health Record (EHR), sometimes referred to as an Electronic Medical Record (EMR). The EHR is a digital version of a patient's paper chart. It provides a real-time, patient-centered record that makes information available instantly and securely to authorized users. An EHR contains a patient's medical history, diagnoses, medications, treatment plans, immunization dates, allergies, radiology images, and lab results. Its widespread adoption is the bedrock upon which other technologies—including telehealth platforms, clinical decision support tools, and modern healthcare payment technology—are built, as they all rely on the data and connectivity provided by the EHR system.

A contactless patient check-in system allows patients to complete registration, forms, and payments from their own device before arriving,...

💡Managing billing for different specialties in one practice is tough. Each department has its own workflow, and traditional systems can't keep up....

The global healthcare sector stands at a critical juncture. Faced with the immense pressures of an aging population, the rising prevalence of chronic...