Improving Cash Flow with Text-to-Pay in DrChrono

💡 Many practices struggle with unpaid balances even when patients want to pay. Delays, missed statements, and outdated billing tools often slow...

5 min read

.jpg) Mira Gwehn Revilla

:

December 20, 2025

Mira Gwehn Revilla

:

December 20, 2025

Delayed payments rarely cause immediate alarm. At first, they look like a few unpaid balances that will likely be resolved later. Over time, those balances grow older and harder to collect.

For many practices using Office Ally, this pattern feels familiar. Visits are completed on schedule. Patients receive statements. Yet revenue arrives weeks later than expected.

This delay creates stress across the organization. Finance teams wait for payments to settle before closing reports. Leaders hesitate to approve new hires or investments because cash flow feels unpredictable.

The problem is not patient refusal. Most patients intend to pay. The issue is friction. Paper statements get lost. Portals require logins that patients forget. Phone payments only work during office hours. Each extra step increases the chance of delay.

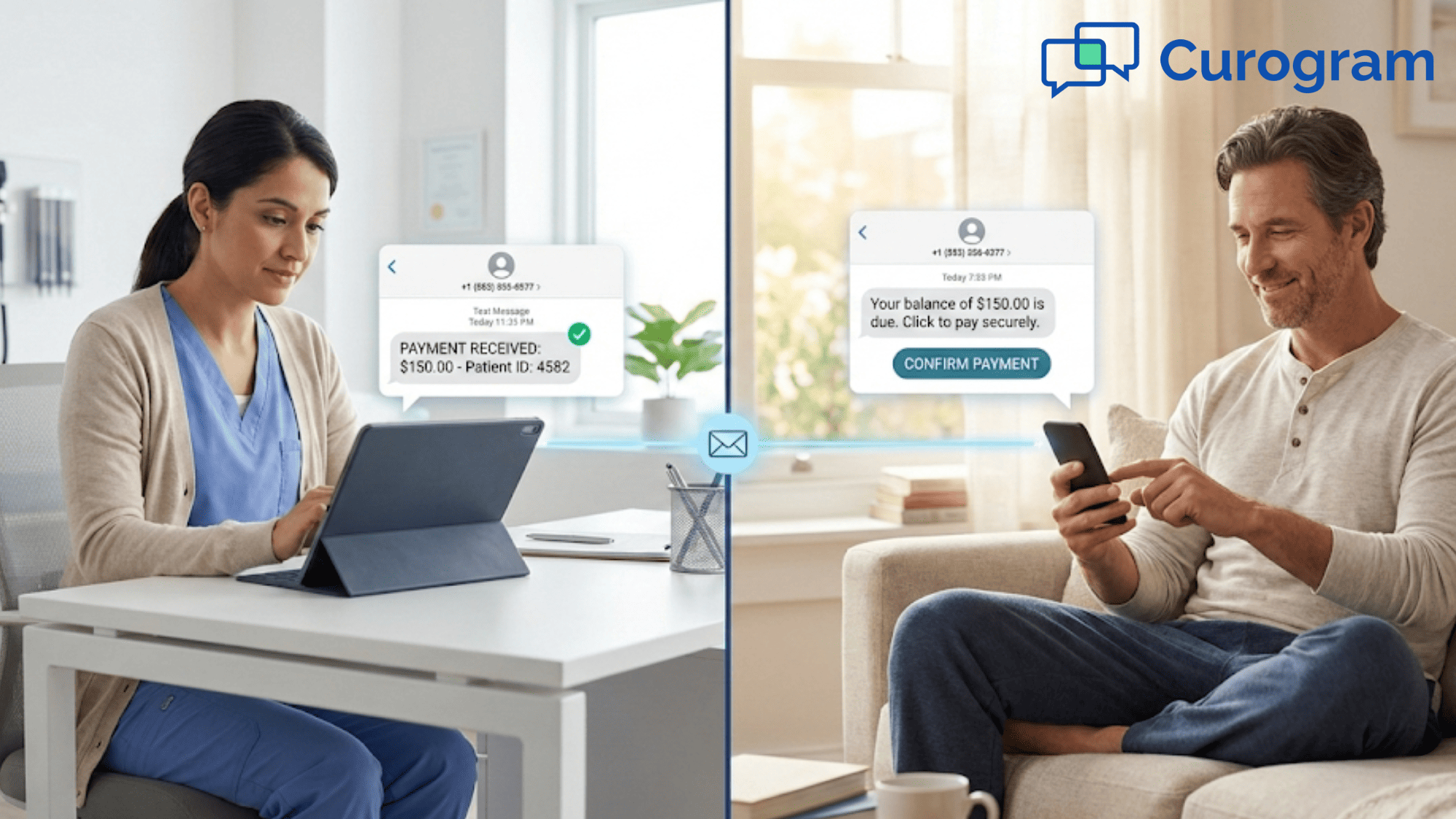

Text-to-pay changes this experience. Instead of asking patients to find a payment option, the payment option comes to them. Secure links arrive on devices patients already use.

To improve cash flow Office Ally text-to-pay solutions help reduce A/R by removing unnecessary steps from the billing process. Payments arrive sooner, and staff spend less time chasing balances.

This article breaks down the business risks of delayed payments, how Curogram improves ROI with text-to-pay, and why executives and finance leaders see stronger control when billing becomes simpler.

When payments are delayed, the impact goes far beyond a single unpaid bill. Small gaps in the billing process can quietly disrupt cash flow, staff workload, and long-term planning. Without text-to-pay, these issues often grow unnoticed until they affect daily operations.

Here are some common risks practices may encounter without text-to-pay:

Delayed payments rarely happen all at once. They build slowly as open balances age, especially when practices rely on manual billing instead of text-based options. Each unpaid balance adds uncertainty to cash flow.

As A/R grows, revenue looks healthy on paper but is not available when needed. This gap creates stress across the organization.

When revenue timing is unclear, leaders hesitate. Budgets are delayed. Hiring and technology upgrades are postponed.

Instead of planning for growth, teams focus on covering gaps.

Billing staff feel the impact first. Daily tasks often include:

As volumes grow, this workload becomes harder to manage.

Paper statements and portal-based payments increase risk. Statements may arrive late. Payments may not be posted right away. Each delay extends the billing cycle.

Patients usually intend to pay. But when billing feels confusing or slow, payment is postponed. Good intentions turn into delays.

Without text-to-pay, practices depend on tools that require extra effort from patients. Each extra step increases drop-off.

Over time, delayed collections limit progress. Practices work harder to earn the same revenue. Financial stress becomes routine instead of temporary.

Text-to-pay improves ROI by shortening the time between care and payment. Instead of waiting for a statement or portal login, patients receive a secure payment link directly on their phone.

Text-to-pay changes when patients act. Instead of waiting for a statement or logging into a portal, patients receive a secure payment link directly on their phone.

This reduces the time between service and payment.

Text-based payments align with daily habits. Patients already check messages. When payment is one tap away, action happens sooner.

Fewer steps mean fewer delays.

Practices using text-to-pay often see:

These impacts of text-based payment directly improve ROI.

As payments arrive sooner, billing teams spend less time on follow-ups. Fewer calls and reminders are needed. Staff effort shifts away from collections.

Curogram delivers payments through secure, HIPAA-compliant messaging. Patients feel confident completing payments when requests are clear and familiar.

Trust reduces hesitation.

For Office Ally users, text-to-pay fits into existing billing processes. Practices improve ROI without disrupting daily operations or retraining staff.

For executives and finance leaders, billing efficiency directly affects visibility and control. When payments arrive on time, data becomes more reliable and planning becomes easier. Text-to-pay helps create this stability by reducing delays across the revenue cycle.

Executives want steady income they can rely on. Finance leaders want reports that reflect reality. Faster payments create predictability. Revenue data becomes more accurate and timely.

Lower A/R reduces financial tension. Cash flow feels managed instead of uncertain from month to month. This control supports better decision-making.

When fewer balances age, finance teams spend less time tracking overdue accounts. That time can be redirected toward:

Thus, work becomes more strategic.

Text-to-pay reduces the cost of collecting each dollar. Digital payments require less manual effort than traditional methods. Practices improve margins without increasing headcount.

Shorter A/R cycles reveal true performance. Leaders gain visibility into trends instead of chasing delayed numbers. Over time, this clarity supports healthier growth.

A multi-location practice using Office Ally struggled with aging balances. Payments often arrived weeks after visits.

After adopting text-to-pay, A/R days dropped by 25%. Payment completion rates increased.

Billing staff spent fewer hours on follow-ups. Monthly revenue became more consistent.

The financial improvement was visible within the first few billing cycles.

Start by reviewing current A/R days. Identify where delays occur.

Assess how patients prefer to pay. Digital options often perform better.

Use this insight to determine whether text-to-pay could improve financial stability.

How Curogram Supports Text-to-Pay for Office Ally Users

Curogram helps practices modernize payments without disrupting daily workflows. Secure text-based payment delivery fits naturally into patient communication.

Office Ally users benefit from faster collections and reduced A/R. Billing teams spend less time chasing balances.

Patients experience simpler billing. Paying by phone feels familiar and convenient. By reducing friction, Curogram helps practices improve cash flow Office Ally text-to-pay strategies are designed to support.

Delayed payments affect more than the bottom line. They shape how practices plan, staff, and grow over time. When revenue arrives late, uncertainty becomes part of daily operations.

Text-to-pay offers a practical way to break this cycle. By removing friction from the billing process, payments move faster and with less effort from staff.

To improve cash flow, Office Ally text-to-pay solutions supported by Curogram help reduce A/R and bring stability to revenue. Leaders gain clearer visibility into financial performance. Finance teams regain a sense of control.

Patients also feel the difference. Billing becomes simpler and easier to understand. Trust grows when payment feels familiar and secure.

By modernizing payments, practices strengthen financial health while supporting better patient experiences. The result is steadier growth built on reliable cash flow.

Boost cash flow and patient satisfaction with text-to-pay for Office Ally. Book your demo today.

Small practices often have limited billing staff. Text-to-pay reduces the need for repeated follow-ups and phone calls. Payments arrive faster with less manual effort. This improves collections without increasing operating costs.

Patients are more likely to pay when billing feels clear and secure. Confusing or unfamiliar payment requests cause hesitation. Trust removes doubt and reduces delays. When patients feel comfortable, payment completion improves.

Leaders can track changes in A/R days before and after using text-to-pay. They can also monitor payment completion rates and staff time spent on billing. Fewer follow-ups and faster payments signal improvement. Together, these measures show return on investment.

💡 Many practices struggle with unpaid balances even when patients want to pay. Delays, missed statements, and outdated billing tools often slow...

💡 Text-to-pay solutions help imaging centers improve cash flow and reduce accounts receivable days significantly. When integrated with Exa...

💡 Many practices struggle to improve cash flow Dolphin text-to-pay can support when payments are delayed or hard to collect. Delayed balances...